This guide describes how to issue a payment for services (such as a guest speaker payment) to an international guest when services were performed within the United States. Review Completing the Tax Information Section for guidance on determining location of performance for services rendered online.

Visit the Travel Reimbursements for International Guests page for information about booking or reimbursing travel expenses.

Click a button below to learn about that part of the process.

Before the guest is invited

- Consult the Office of International Services for resources and help determining which visa status is most appropriate for your guest. Be aware that there may be extended processing times if a visa is needed.

- For general guidance on hiring and hosting a guest, visit Hiring and hosting international faculty, staff, and visitors.

- For specific guidance on visitor visa types, visit Short-term visits to IU.

Before the guest arrives

- Search for the guest in BUY.IU. If they have an active supplier record, ensure the registration type is Profile 2 or Individual.

- No record? Submit a new supplier request form.

- Inactive or Profile 3 type record? Submit a Supplier Edit Request Form.

- Review supplier record for their preferred currency. Foreign suppliers can be paid in US Dollars (USD) or a foreign currency. Currency is selected by the supplier during the supplier registration process.

- Is the supplier being paid $5,000 US Dollars or more? Submit a Contract Request Form in BUY.IU. International contracts require considerable processing time, so begin the contract process as soon as possible.

- Determine how the supplier will be paid. Payments are processed in BUY.IU via non-catalog order or check request form.

- Use a non-catalog order when: your order involves a contract, or you are issuing multiple payments to the supplier. Submit the non-catalog order prior to the supplier’s visit. Additional instructions for completing non-catalog orders can be found at the Non-Catalog Order Resource Center.

- Use a check request when: you are issuing a one-time payment that is less than $5,000 US Dollars and does not require a contract. Generally, check requests are submitted after the supplier’s visit.

- Make the supplier aware that their payment is subject to U.S. taxes. This means that the net payment amount they receive may be less than the agreed upon amount. International guests can file a US tax return to receive a potential refund for the tax withholding. Encourage your guest to review the Tax Treaty Benefits page to see if they may be able to apply for tax treaty benefits. If they are, they will be required to complete the International Tax Questionnaire via the Foreign National Information System (FNIS). This process is initiated and managed by University Tax Services.

- Within your department, discuss whether you will “gross up” the payment(s) to cover any applicable taxes. Use the NRA Calculator to determine the additional expense to your department, should you pursue this.

During the visit

An international guest being paid for services performed within the U.S. must provide documentation proving they had a right to enter the county. This documentation is submitted to University Tax Services by the hosting department.

- Collect one of the following documents:

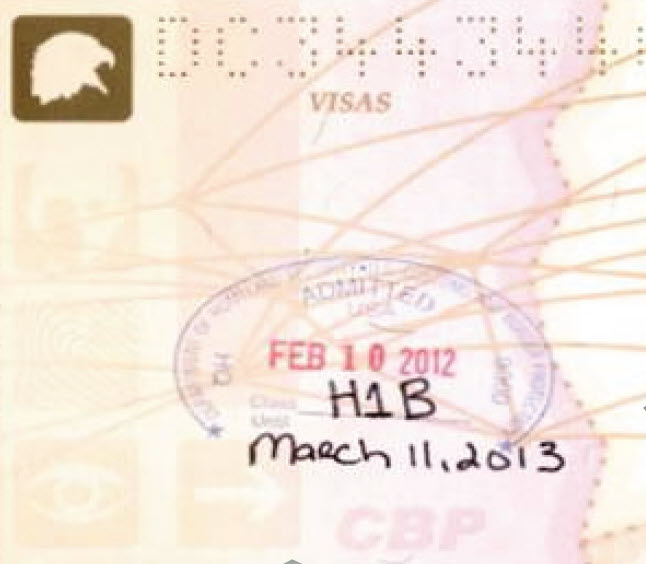

- Passport with Admission stamp.

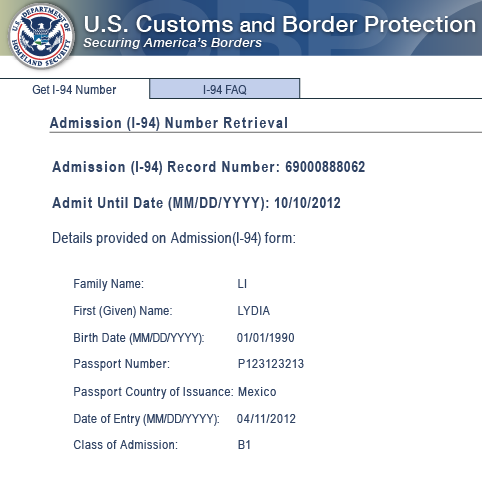

- I-94 Website printout. An international guest can visit CBP online I-94 to retrieve a copy of their most recent Form I-94.

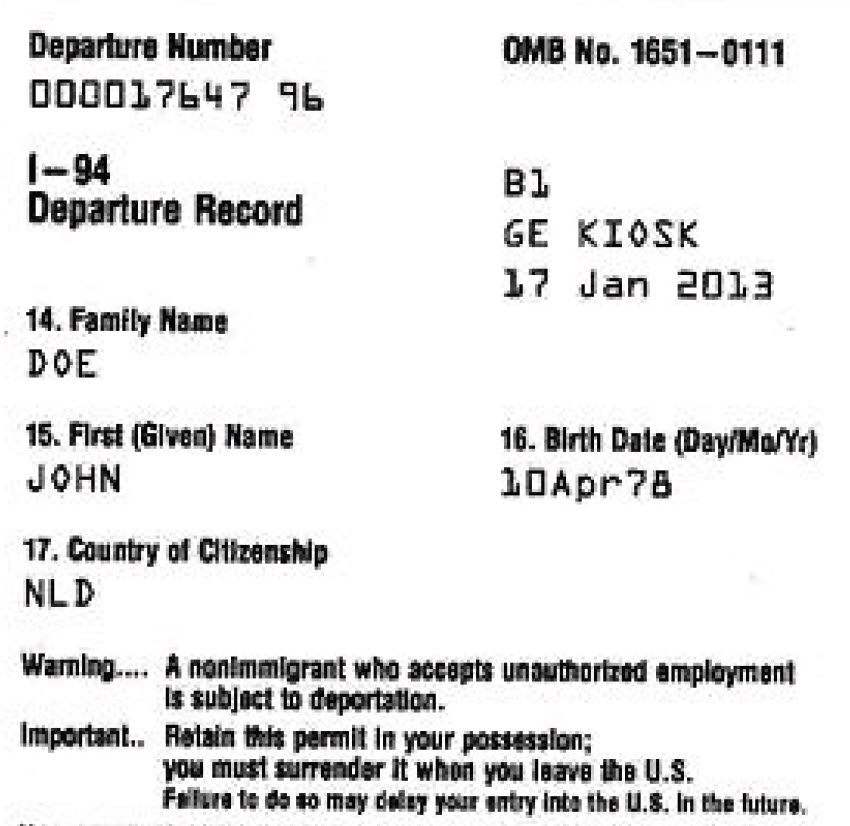

- Form I-94A card.

- Global Entry I-94.