Receipt documents are logged on purchase orders but the need for a receipt is triggered by invoices. Receipts allow the department to verify that goods were received or services were performed and that the corresponding invoice should be paid in high dollar or high risk situations.

Receipts are not required in all situations. This page outlines system and university-level receiving requirements as defined in SOP-PURCH-19: BUY.IU Receiving. Your department may require receipts in additional situations. Always consult your department to ensure you're following local procedures.

Click a button below to learn more about that situation.

Quantity Receipts

Quantity receipts are required on one-time requisitions whose value is greater than or equal to $5,000. A one-time order refers to a requisition whose Recurring Payments section was not completed. A quantity receipt is required each time an invoice is processed, regardless of the invoice amount.

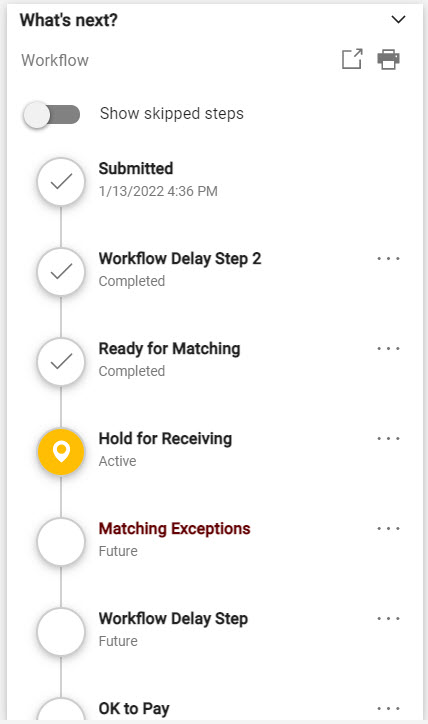

If a receipt has not already been logged, the invoice routes to the Hold for Receiving workflow stop, pictured left. The PO Owner receives a notification that a receipt is needed.

If a receipt has not already been logged, the invoice routes to the Hold for Receiving workflow stop, pictured left. The PO Owner receives a notification that a receipt is needed.

Invoices remain in the Hold for Receiving stop until proper receipts are logged or until 10 days before the Invoice Due Date. This holding period is referred to as Receiving Lead Time. "Proper receipts" refers to the amount invoiced being verified by the amount receipted.

Once Receiving Lead Time expires, the invoice routes forward to the Matching Exceptions workflow stop for fiscal review.

The picture to the right shows the Matching Exceptions workflow stop. Notice that the Hold for Receiving stop shows as Completed. This is not accurate. Fiscal approvers must review the Matching tab of the invoice or the Receipt section of the purchase order to ensure required receipts have been logged.

Fiscal approvers are responsible for contacting the PO Owner or other individual responsible for logging receipts if a receipt is needed.

Cost Receipts

Generally, there are two situations that require cost receipts:

Recurring orders

Recurring orders

A recurring order is created by completing the Recurring Payments section of the requisition. Recurring order invoices that have a value of $5,000 or more require a receipt.

The PO Owner does not receive a notification if a cost receipt is required on a recurring order invoice. PO Owners should use searches in BUY.IU to locate recurring invoices which require a receipt.

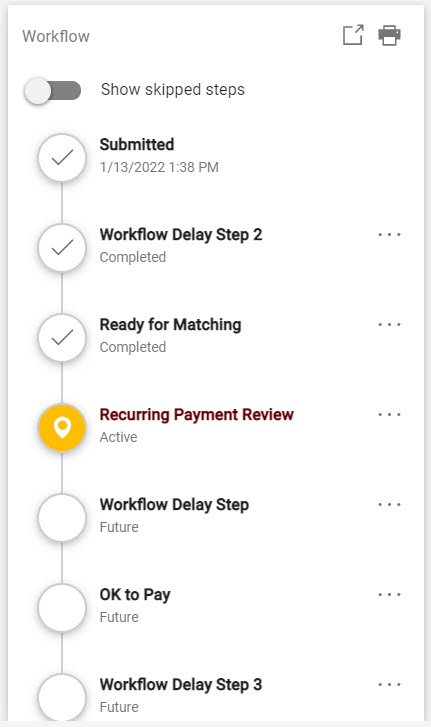

Invoices that meet this requirement route to the Recurring Payment Review workflow stop, pictured to the left. Fiscal approvers are responsible for reviewing the PO and ensuring proper receipts have been logged. "Proper receipts" meaning the amount invoiced is verified by the receipt amount.

Capital asset purchases

Whether a good is considered a capital asset is determined by its purchase price, among other factors. Since capital assets have a value over $5,000, any invoice associated with a capital asset requires a receipt. The PO Owner receives a notification from BUY.IU if a receipt needs to be logged. Review the Quantity Receipts section above to learn more.

Subawards

Contract & Grant subawards are established using commodity code ORA1. These types of orders are usually recurring orders, but do not behave like a typical recurring order.

Instead, every subaward invoice, regardless of dollar amount, requires a receipt document. The PO Owner receives a notification that a receipt is required. Fiscal approvers are responsible for ensuring proper receipts are completed prior to approving any invoices. "Proper receipts" means the amount invoiced is verified by the amount receipted. Review the cost receipt guide for additional considerations related to the receipt document itself.

Foreign Currency Orders

A foreign currency order refers to a purchase order established in a non-US Dollar currency. The currency used in the order and for invoicing is driven by what is designated on the supplier's profile.

A receipt is required for any foreign currency order invoice, regardless of the value of the invoice. A quantity or cost receipt may be used depending on the type of order that was placed. If a quantity receipt is required, the PO owner will receive a notification that a receipt is needed. Review the foreign currency receipt guide to learn more.

Check Requests

Generally, receiving is not required for check request requisitions. The only check request form which requires receiving is the Purchases for Resale form. Purchases for Resale requisitions whose value is greater than or equal to $5,000 route to the "Hold for Receiving" workflow stop and follow the rules outlined in the Quantity Receipt section above.