The Tax Information section of a requisition must be completed when placing an order for services in BUY.IU. Information entered in this section is used by University Tax Services to calculate tax liability, adjust payments due to this liability, gross up payments per request, and report contractor earnings to some US states.

This information is required when establishing orders for services. If left incomplete, the requisition will be returned to the submitter.

Click a button below to jump to instructions for that type of order.

Orders Placed with Domestic Suppliers

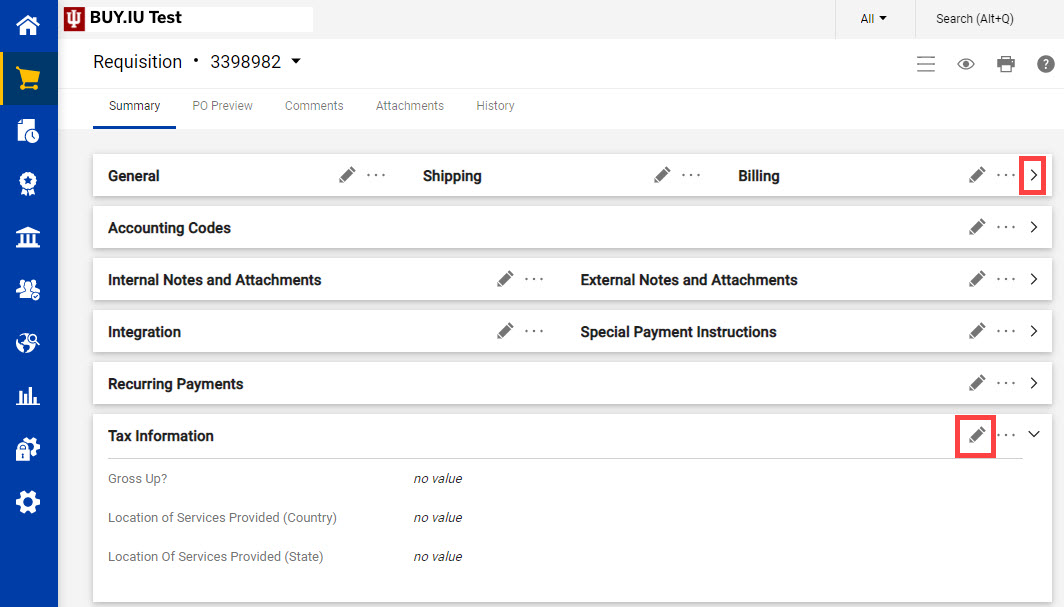

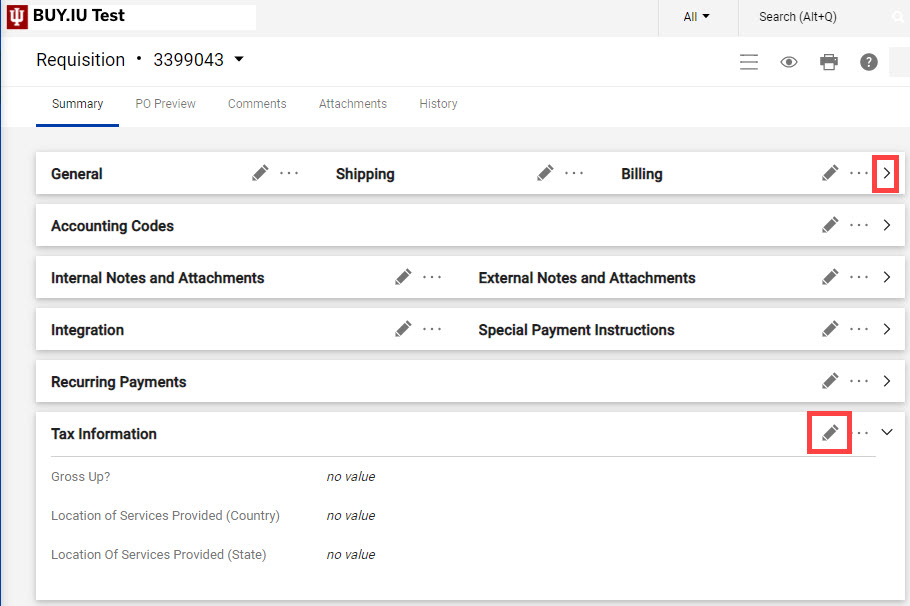

Use the carets found in the top right corners of requisition sections to collapse sections to reveal the Tax Information section, or simply scroll down the page.

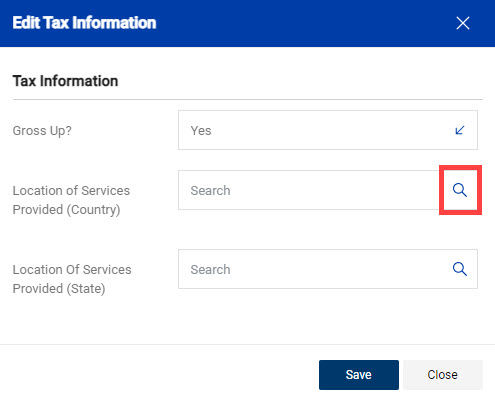

Click the pencil icon in the top right corner of the Tax Information section to edit.

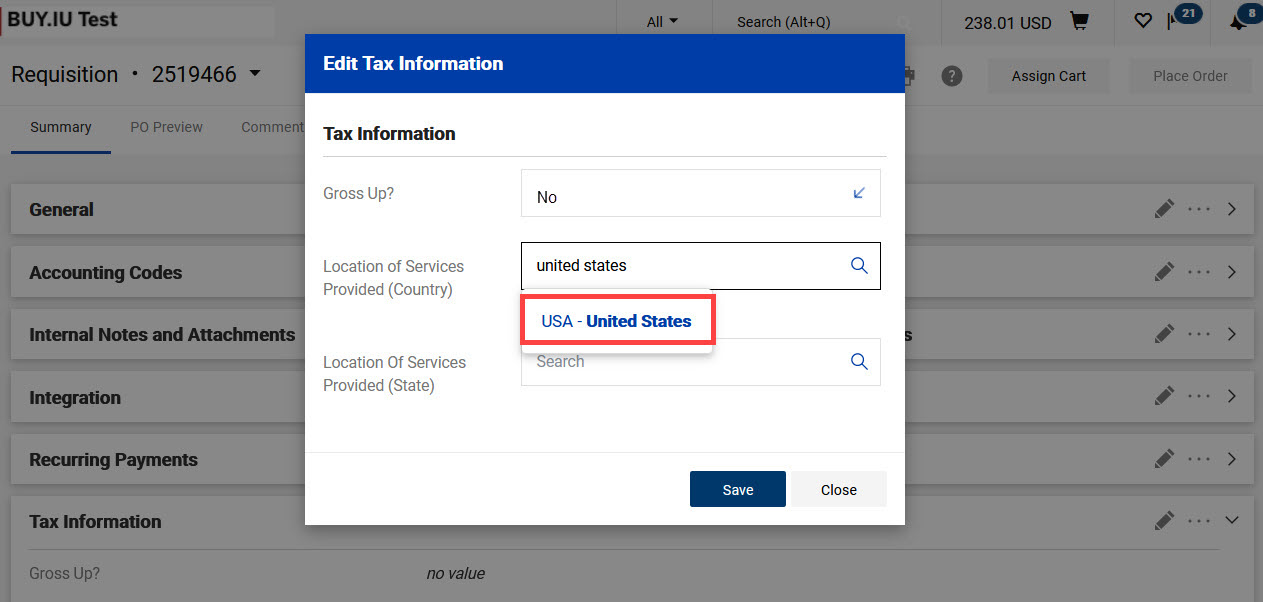

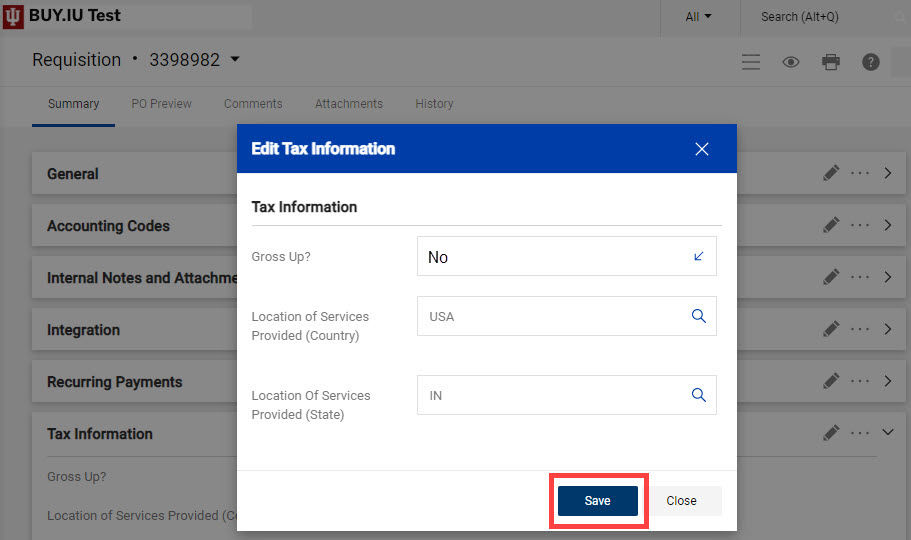

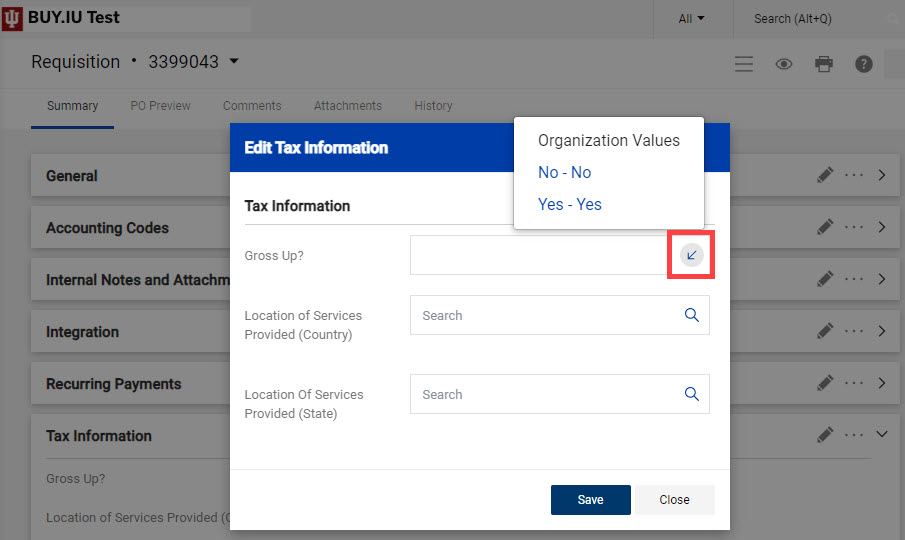

Complete the Services Provided (in what Country) field by typing "United States" in the field and selecting "USA - United States" when it pops up.

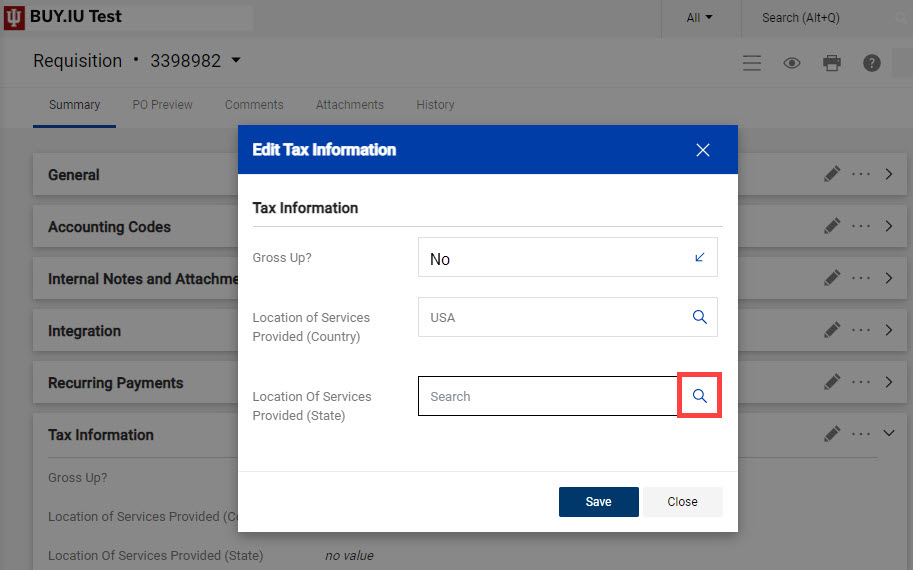

Complete the Location of Services Provided (State) field by typing the state name and selecting from the auto-populated list, or by clicking the magnifying glass to run a full search.

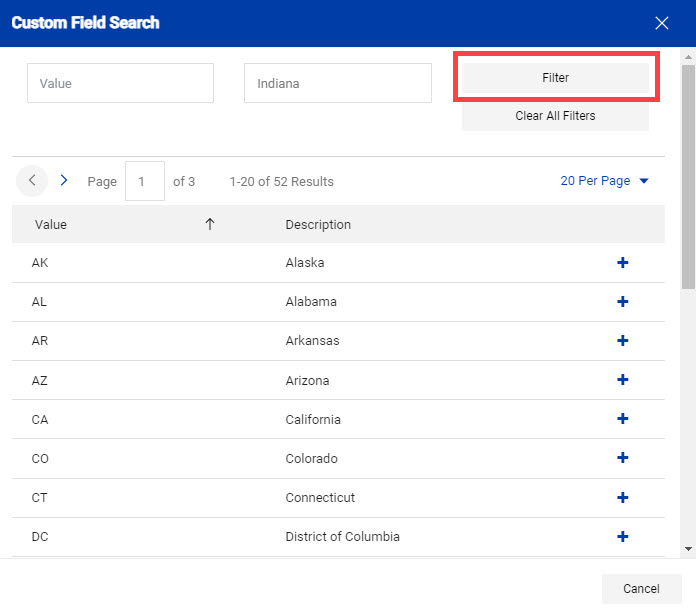

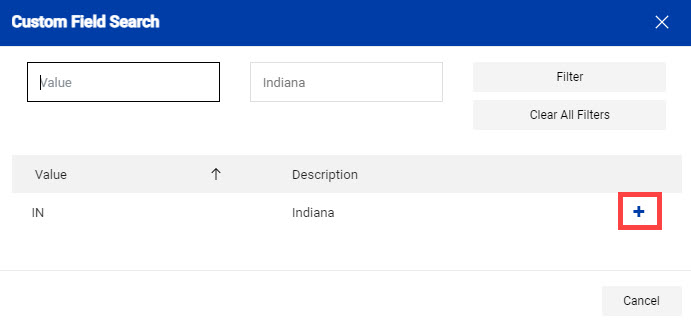

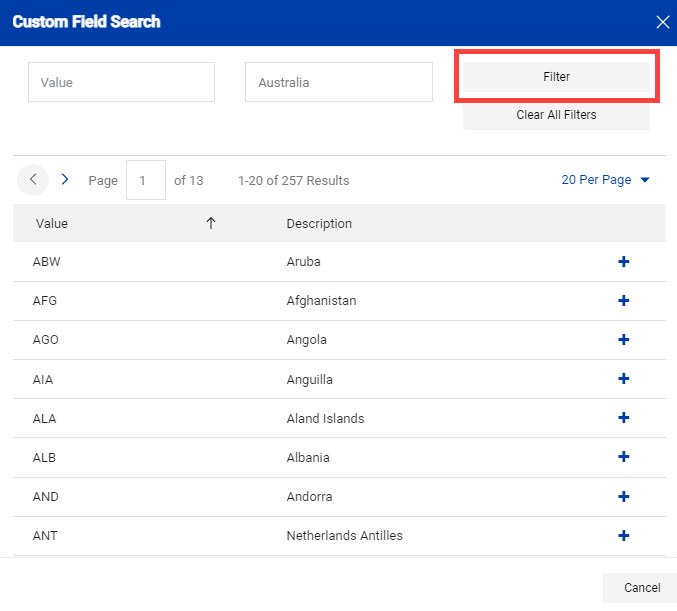

In our example, services are being performed in Indiana, so we'll enter "Indiana" in the Description field to search for the state code. Click Filter to search.

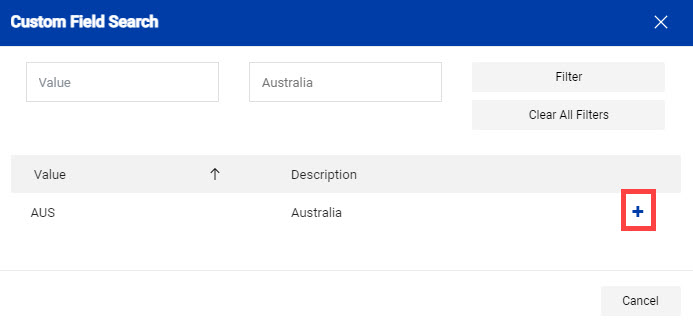

Click the plus sign next to the state to return it to the requisition.

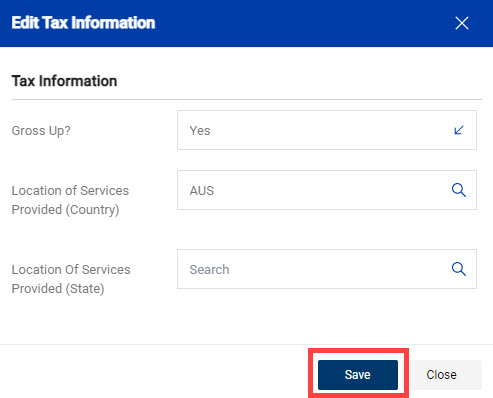

Once all fields are complete, click Save to save your changes.

The Tax Information section is now complete.

Orders Placed with Foreign Suppliers

Use the carets found in the top right corners of requisition sections to collapse sections to reveal the Tax Information section, or simply scroll down the page. Click the pencil icon in the top right corner of the Tax Information section to edit.