Non-employee travel expenses are subject to the same policies and requirements as employee travel. This page walks through the additional steps that are unique to non-employee reporting.

Since non-employee guests cannot access IU systems, a travel arranger or delegate from the hosting department must complete expense reporting on the guest’s behalf.

Before you start, you will need:

- Guest’s approved and active BUY.IU supplier “p” number

- Guest’s address

- Review this walkthrough to find the guest’s Remittance Address found on their BUY.IU supplier record

- IU does not mail checks internationally. If guest is international and receiving a wire transfer, review the Wire Transfers in Emburse Enterprise page.

- Receipts where required

- IU account number(s) that will fund the expense(s)

- If reconciling, an unused Credit Card Item in the eWallet of the travel arranger who booked on the guest’s behalf

Create the report

Non-employee expense reports are submitted from the travel arranger’s Emburse Enterprise profile; you will not search for the guest in the employee traveler list.

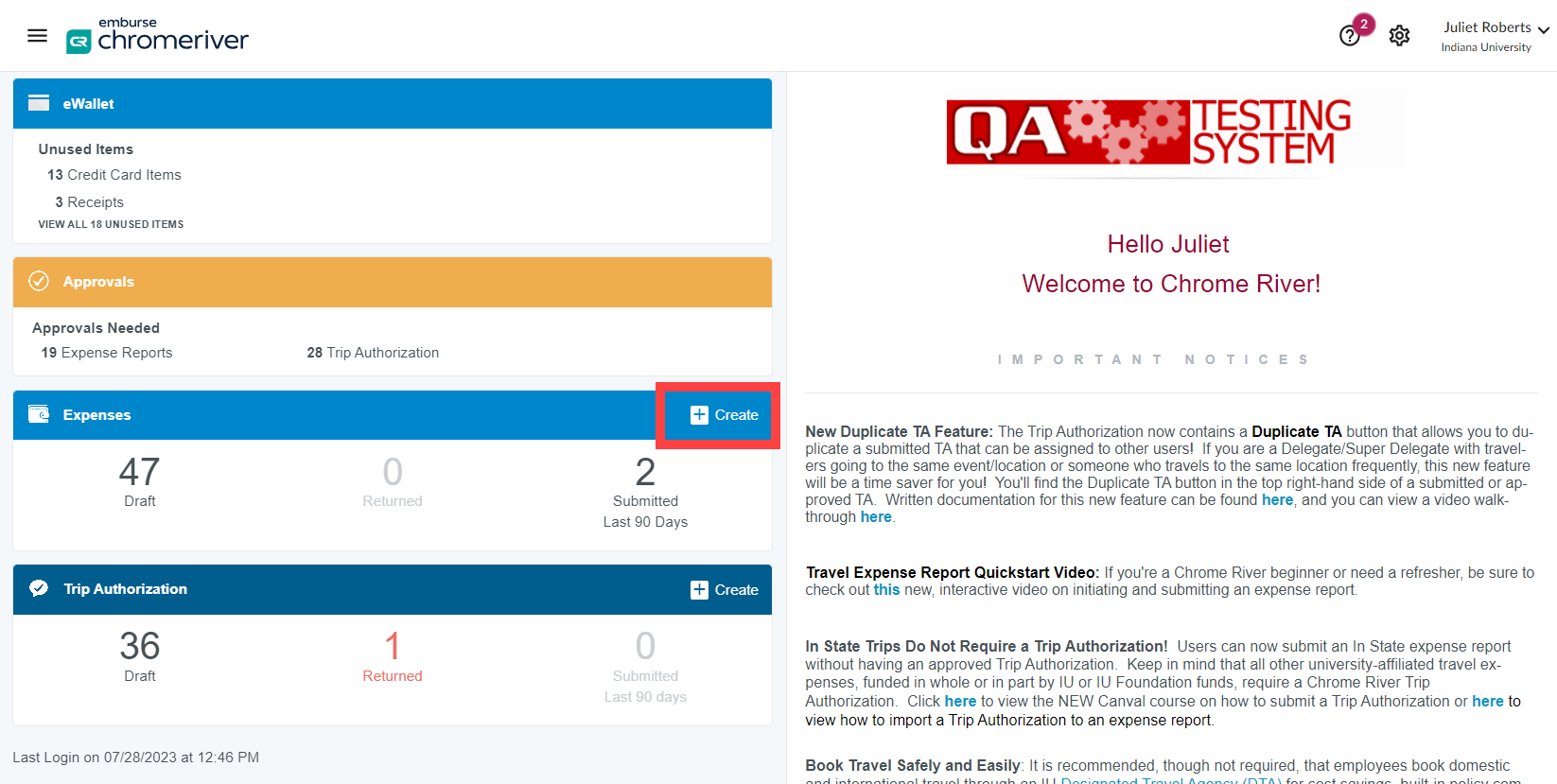

From your Emburse Enterprise profile, create a new expense report by clicking +Create on the expenses ribbon.

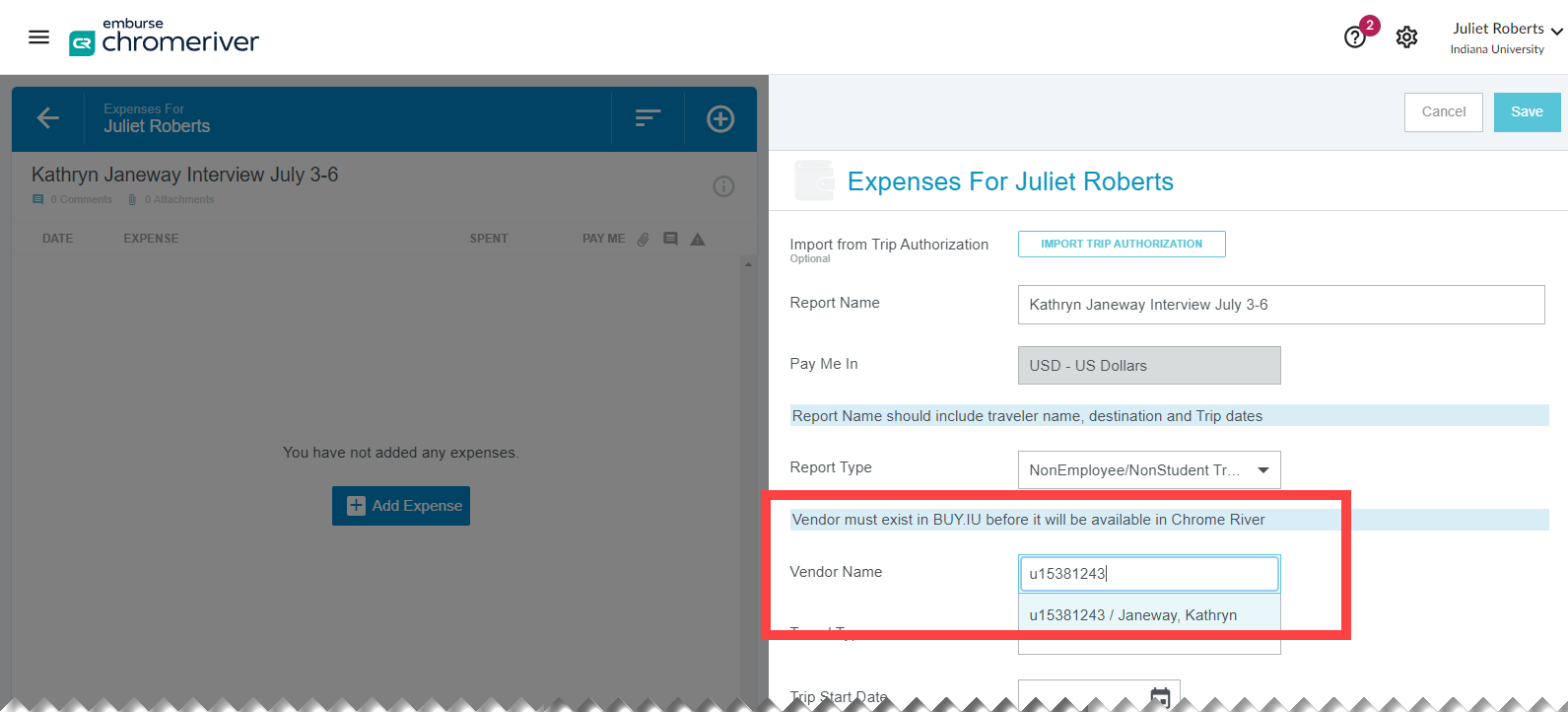

On the new report, import a Trip Authorization or fill out the Report Name with a title that describes the trip or the expenses at a glance. We recommend including the guest’s name, trip purpose or location, and dates.

In this example, we’ve entered “Kathryn Janeway Interview July 3-6.”

In the Report Type dropdown, select Non-employee/Nonstudent Travel. Additional fields will appear.

Search for your guest by entering their approved BUY.IU supplier number or “p” number into the Vendor Name field. You can also search by name. The search may take several seconds to return. When the guest’s name appears, select it from the drop-down menu.

If you cannot find your guest in this search box, contact Supplier Data Management via the Purchasing support form. Select form options “Suppliers” then “Traveler not available in Emburse Enterprise.” You will not be able to proceed until the guest’s supplier record is available in Emburse Enterprise.

The next required section that is unique to the Non-employee report is the Vendor Address. This is the address to which any reimbursement checks will be mailed.

If you are only reconciling IU-prepaid expenses on this report, enter NA in each Address field. If you are requesting reimbursements on this report, enter the guest’s remittance address found in BUY.IU.

IU does not mail checks internationally. International guests may receive reimbursement payments via wire transfer. Check the box next to Check for Wire Payment and fill out the resulting fields. Review the Wire Transfers in Emburse Enterprise walkthrough for help.

Click Save in the upper right corner.

After clicking Save, the expense report is created. The rest of the expense reporting process is the same as the employee expense reporting process. Visit the Prepaid Expense Reconciliation walkthrough or Travel Reimbursement walkthrough for step-by-step guidance on each process.