Research participants who will receive $600 or more over the course of a calendar year must complete the supplier registration process.

Payments at or over $600 exceed the IRS threshold and are considered taxable income. IU must have the individual’s tax information on file to report earnings to the IRS. Research participants also receive a 1099-MISC tax form for tax filing purposes.

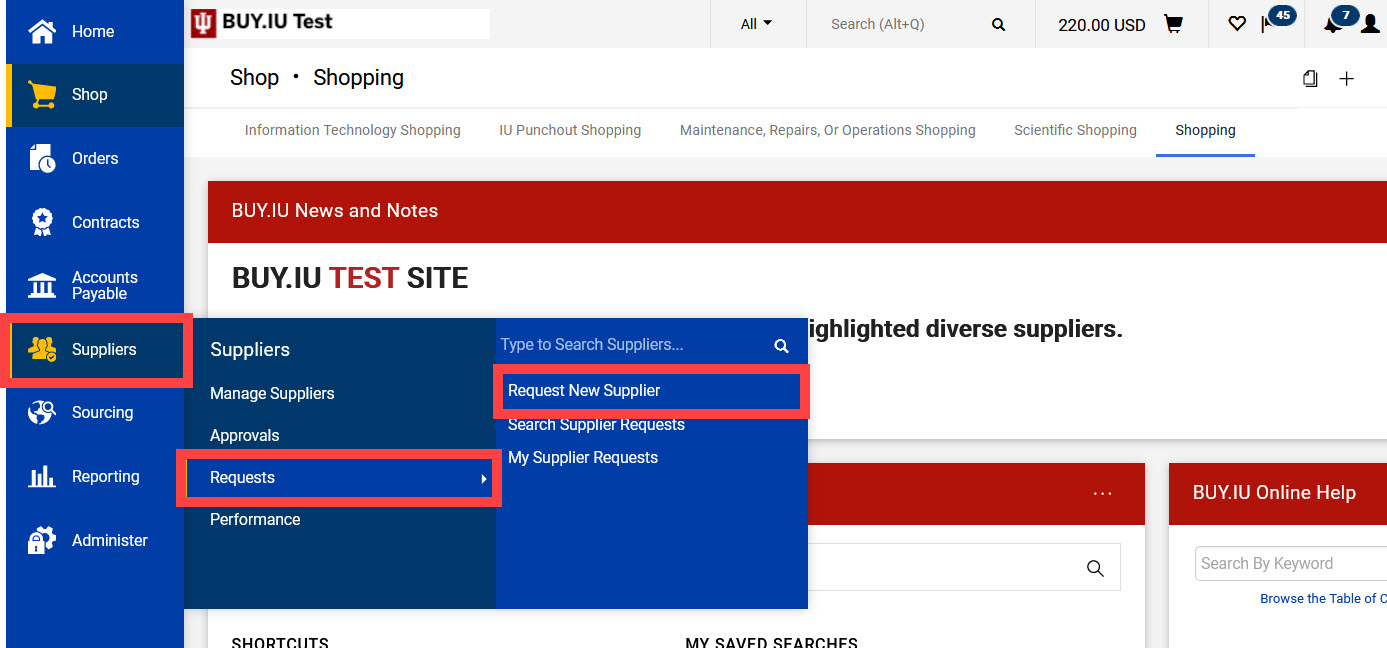

In BUY.IU, navigate to the Suppliers module, Requests, then Request New Supplier.

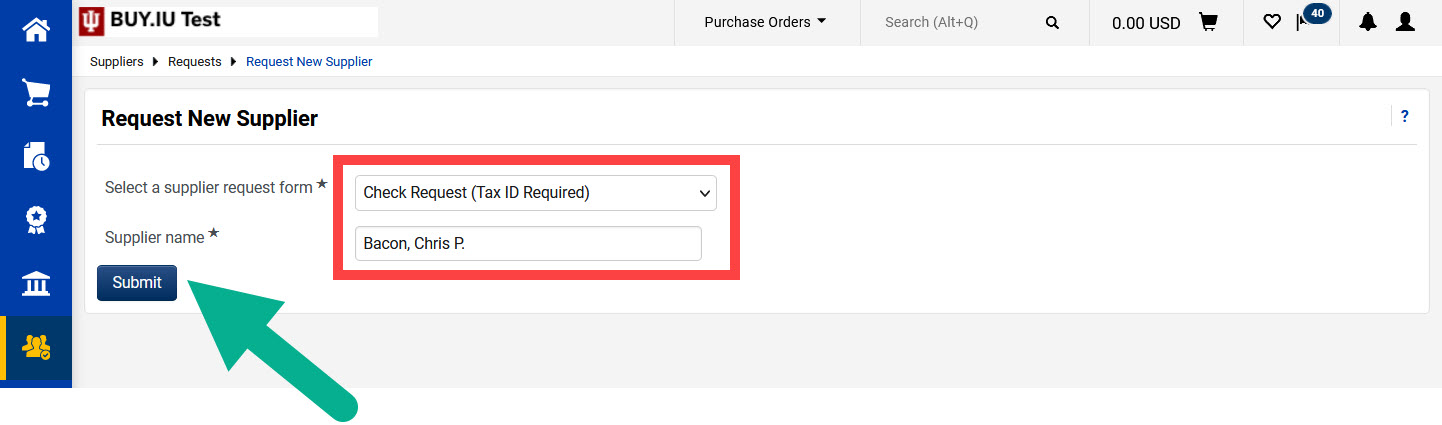

A new window opens. Fields marked with a star are required.

Select Check Request (Tax ID Required) from the drop-down menu and enter the research participant's legal name in the Supplier name field.

Click Submit to access the form.

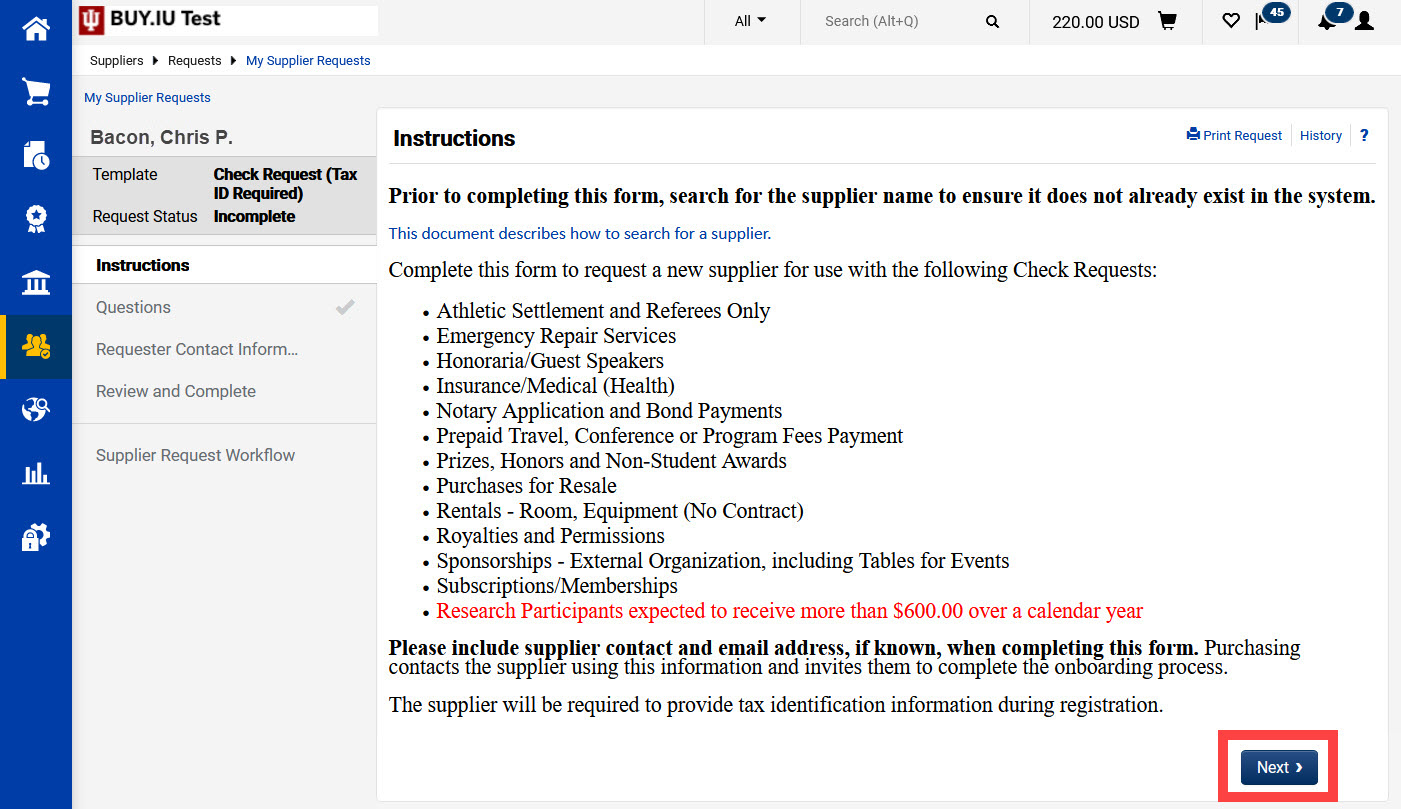

Review the Instructions page and click Next.

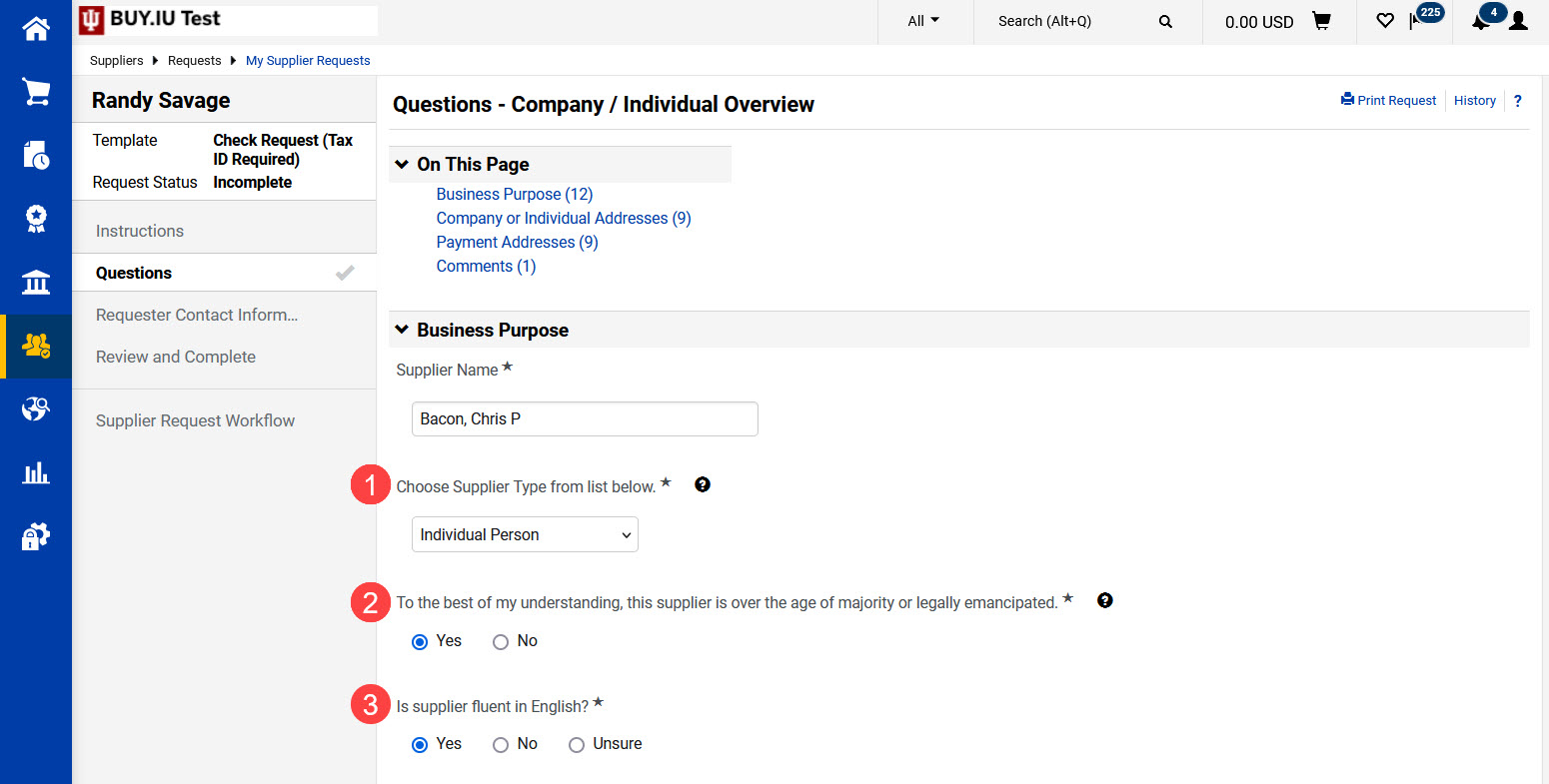

The Business Purpose section of the form collects general information about the supplier. Complete the following fields:

- Supplier Type: Select Individual Person.

- Age of majority question: If you answer "No" to this question, a new set of fields appear to collect the contact information of the supplier's parent or legal guardian. Review this Minors and Supplier Registration newsletter article to learn more.

- English fluency question: Answer to the best of your knowledge. If you answer "No" or "Unsure," the Supplier Data Management (SDM) team may contact you to request help communicating with the supplier.

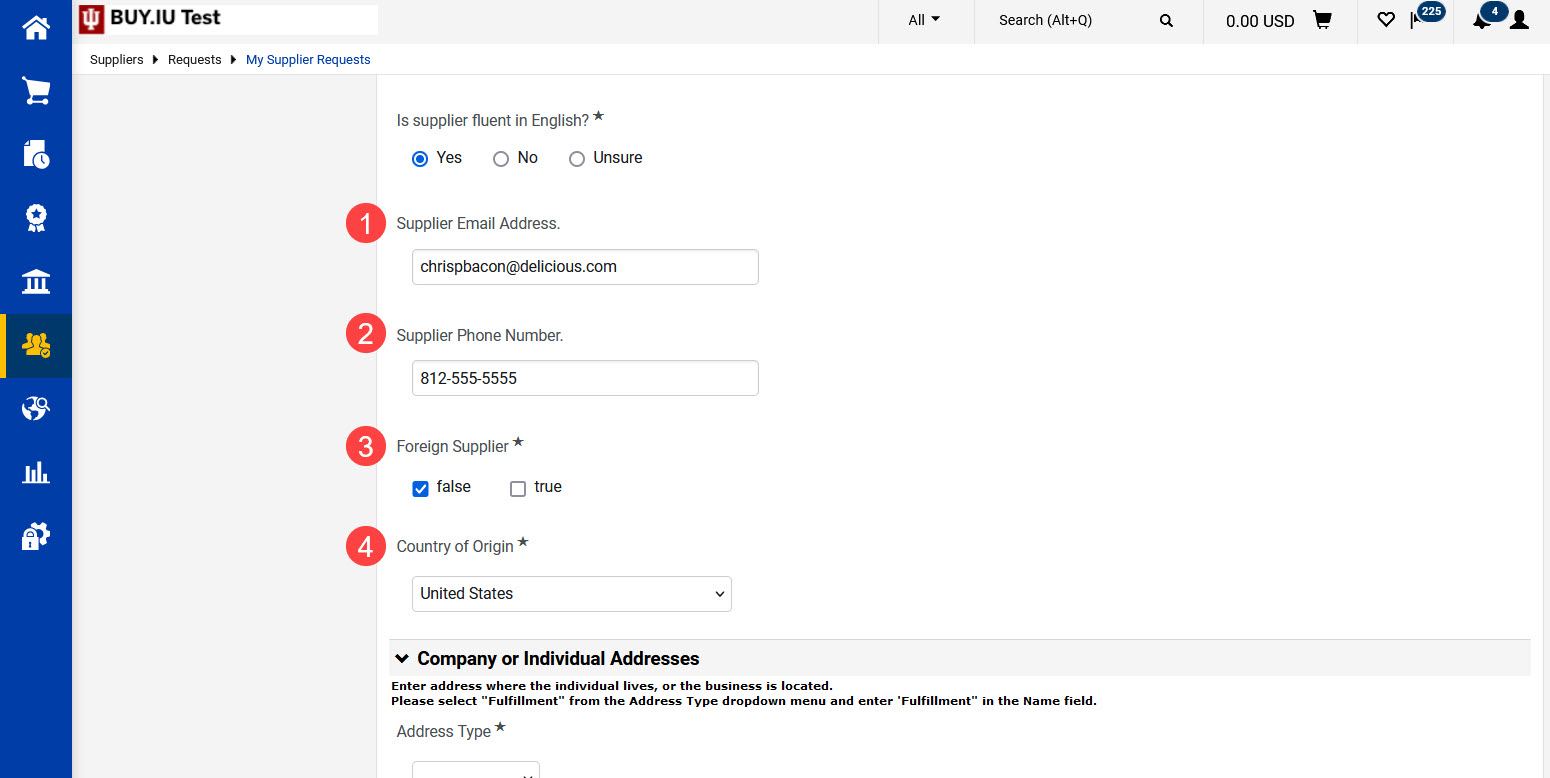

Scroll down the page and complete the rest of the Business Purpose section as follows:

- Supplier Email Address: The email address where the supplier's registration invitation should be sent.

- Supplier Phone Number: The best contact phone number for the supplier.

- Foreign Supplier: Check the box next to "true" if the supplier's country of residence is outside of the United States.

- Country of Origin: The country where the supplier is taxed.

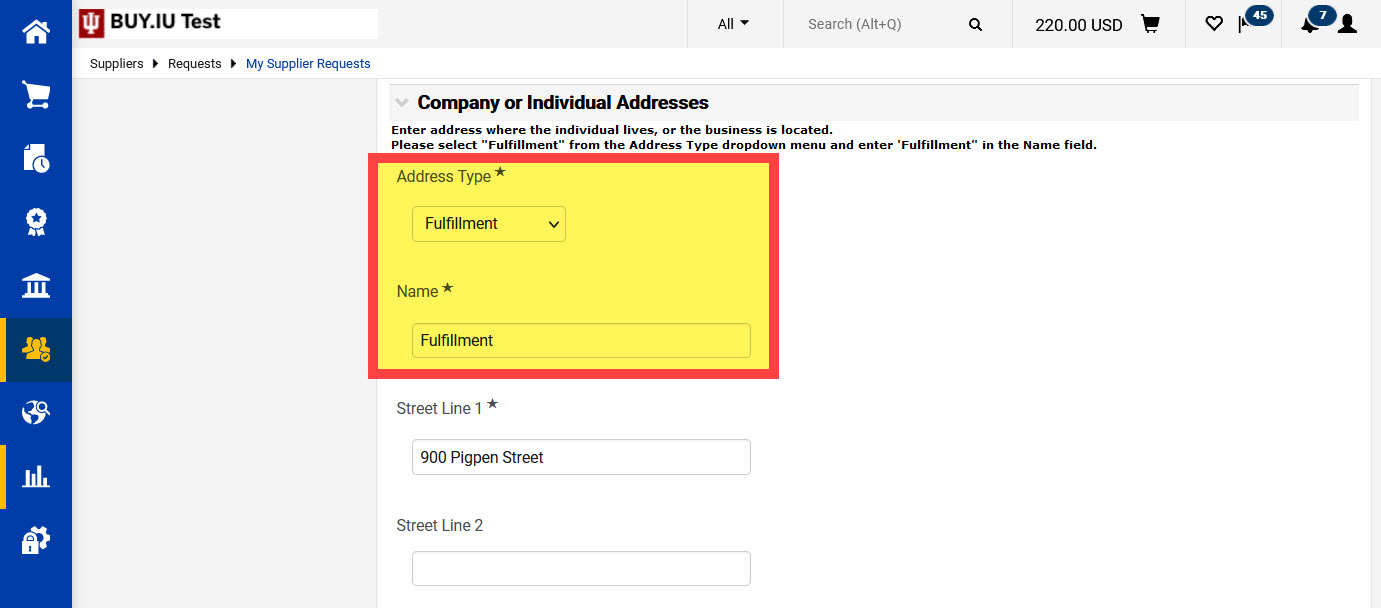

Next, complete the Company or Individual Addresses section.

Select “Fulfillment” from the Address Type drop-down menu. Enter the word “Fulfillment” in the Name field.

You must complete the drop-down and Name field as described. If these fields are not completed correctly your request form will be returned to you.

Enter the participant’s physical address information in the appropriate fields.

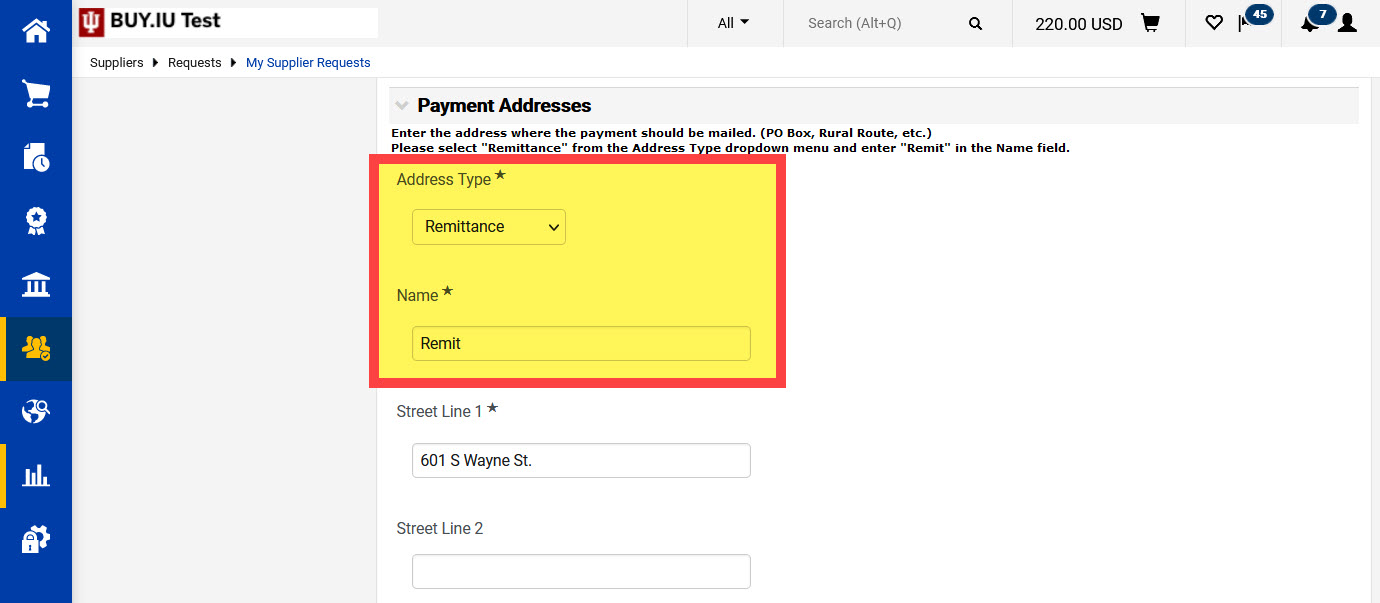

Finally, scroll down to the Payment Address section. Fields marked with a star are required.

Select “Remittance” from the Address Type drop-down menu. Enter the word “Remit” in the Name field.

You must complete the drop-down and Name field as described. If these fields are not completed correctly your request form will be returned to you.

Enter the address where the participant’s payment should be sent in the appropriate fields. This may be the same as their physical, or fulfillment, address you entered above. It must be entered twice.

The participant can enter direct deposit/ACH or wire transfer information when completing the registration process if they prefer to receive electronic payment.

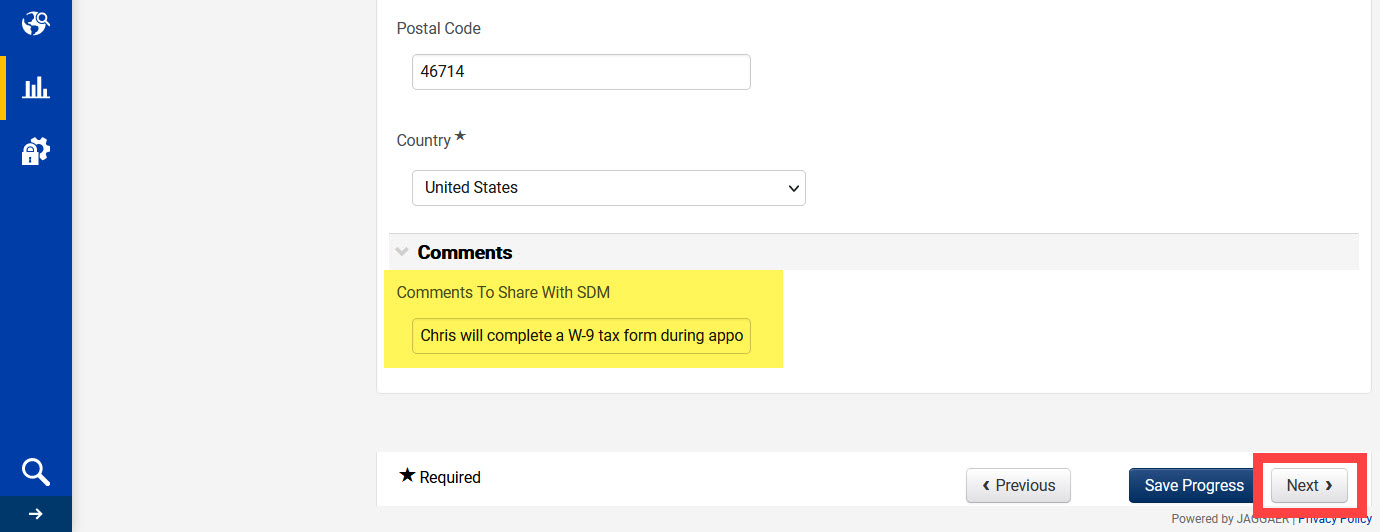

The Comments field at the bottom of the form allows you to share information with the SDM team. The following are examples of helpful comments for SDM:

- If you will collect a W-8 or W-9 tax form from the research participant.

- Alternate names, including preferred names for transitioning individuals.

- The supplier's title (Doctor, Professor, etc.).

Generally, departments should not collect completed tax forms from research participants or other suppliers. However, if this is part of your established business process you may continue to do so.

Tax forms should be securely faxed to (812) 855-7839. Securely store tax forms in your department until you receive confirmation that the supplier record is approved and ready to use.

Enter any notes for SDM in the Comments field and click Next.

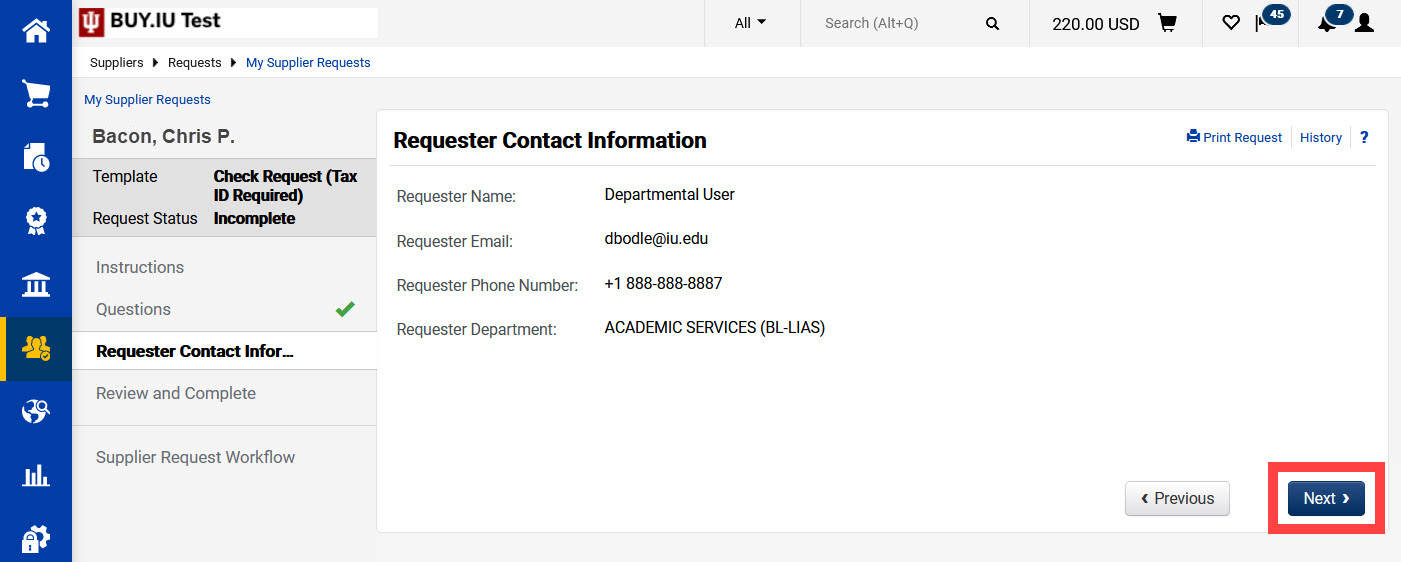

The next page confirms your contact information. Click Next.

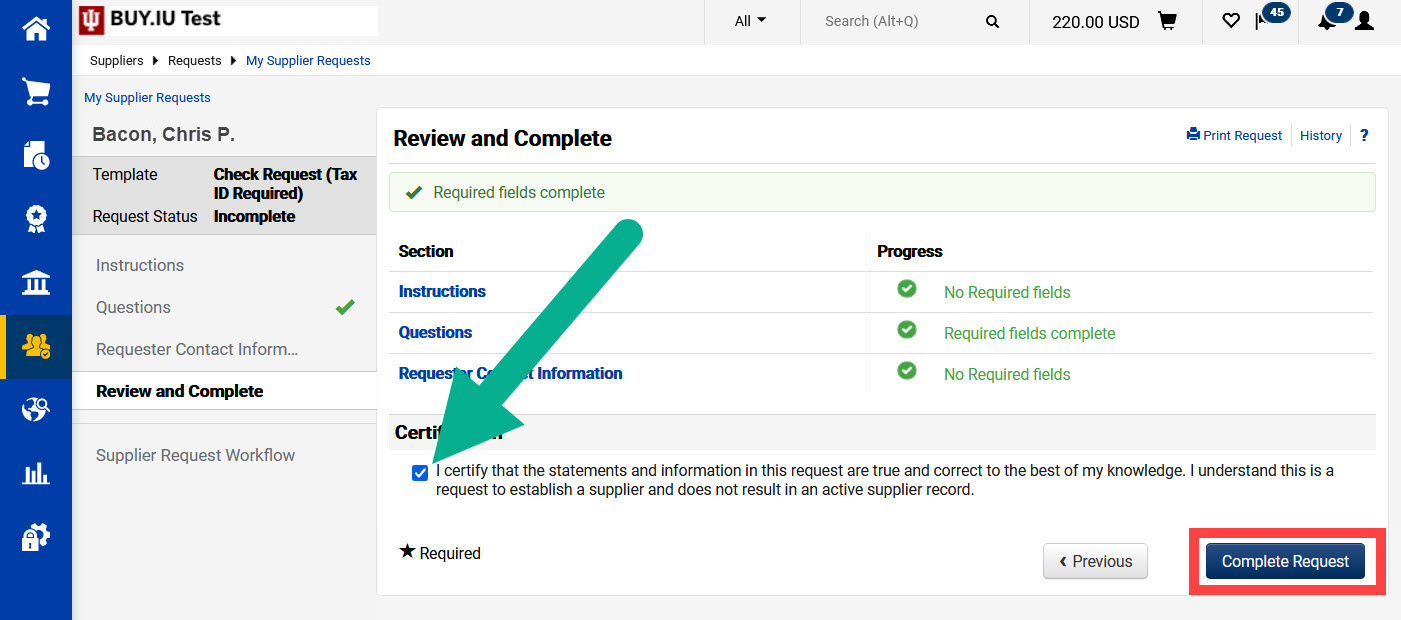

Check the box next to the statement of attestation and click Complete Request to submit the form.

The form routes to SDM for review. A Onboarding Consultant will contact the participant and offer to walk them through the registration process over the phone. Alternatively, if a tax form will be faxed by the department, SDM will enter the tax information once it is received.

You will receive an email notification when the supplier is approved and ready to use.