In October 2022, we shared common Car Rental Add-Ons that serve a legitimate business purpose. This month, we explore a new required field on Chrome River reports that prompts report creators to enter a business justification for reimbursement of these Add-Ons.

As of November, 2022, rental car add-ons require a business justification along with department approval to be reimbursed. Previously, there was no alert of this requirement within Chrome River, so car rental expenses were often returned to the submitter for additional information.

This feature will reduce the need for your approver to return your report with questions about car rental add-ons by providing the justification up front. This helps approvers understand the nature of the expense and reduces the time it takes for your report to reach final approval, resulting in a faster car rental reimbursement.

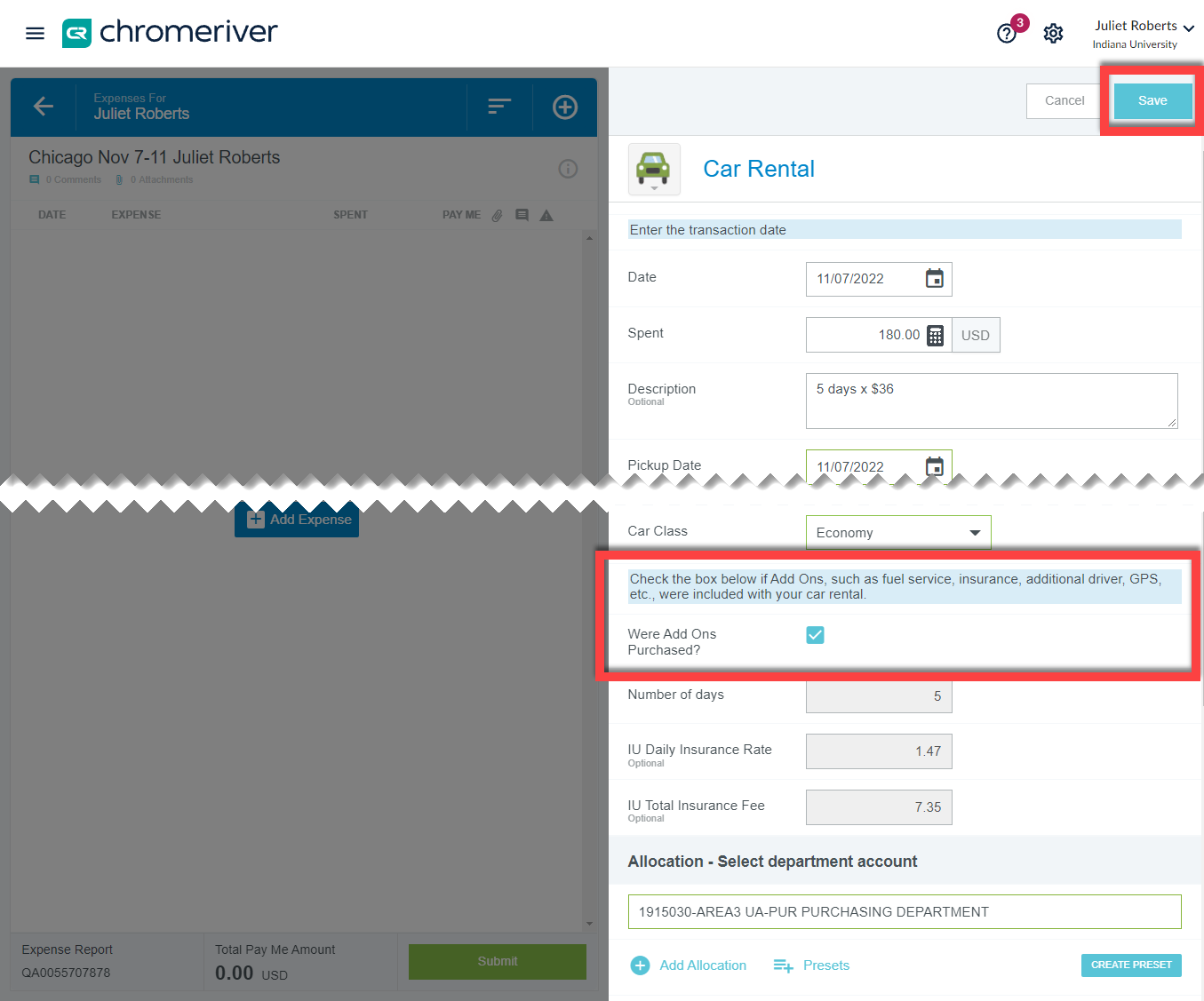

When adding the Car Rental expense to your expense report, you will now be prompted to check a box indicating whether any Add-Ons or upgrades were purchased. Check the box if the answer is Yes. Complete the expense details and click Save in the upper right corner.

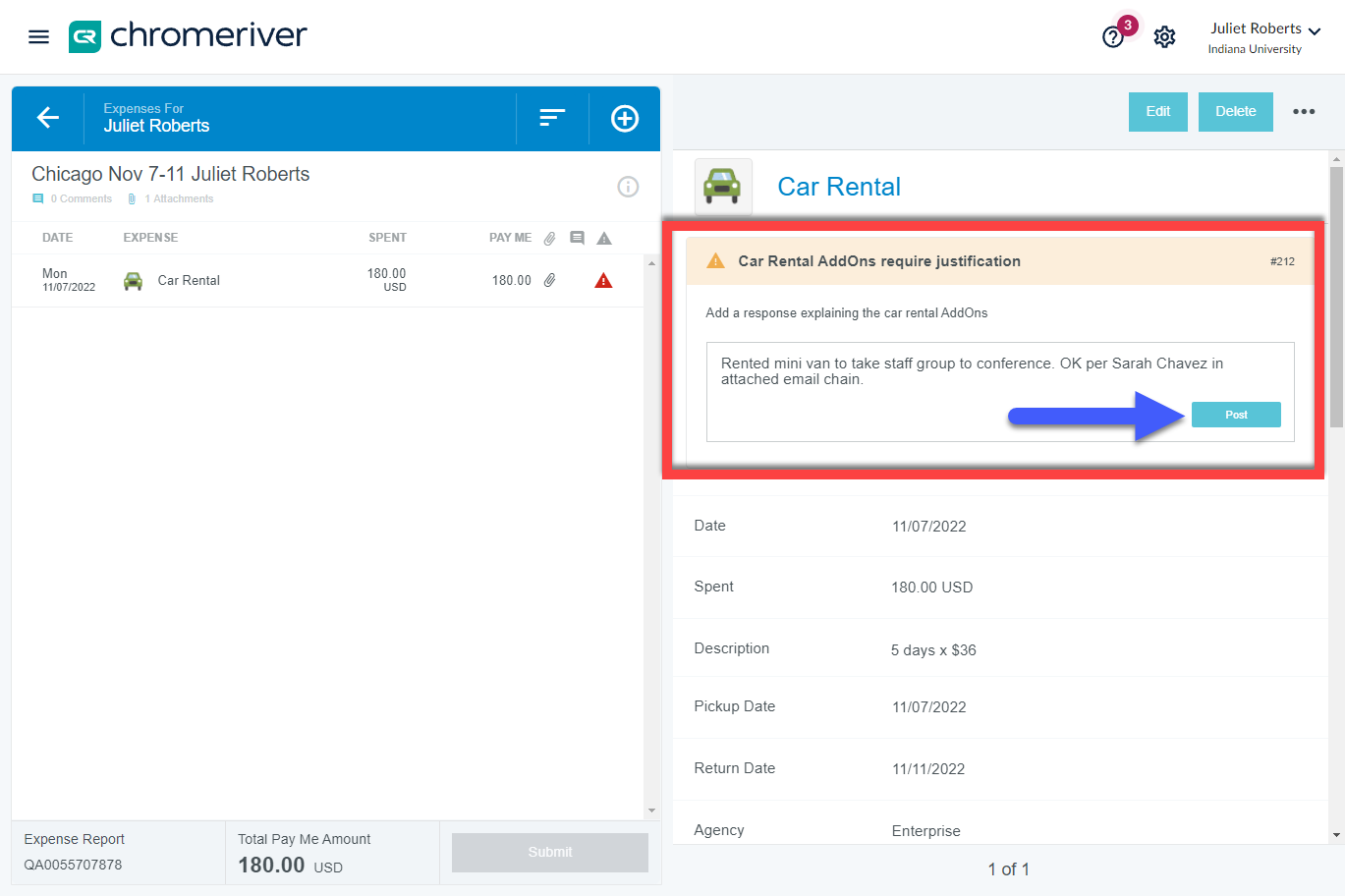

After clicking Save, an error message will appear, asking the submitter to explain the Add-Ons. Describe the Add-On or upgraded car along with your approver’s prior consent. Adding any relevant attachments or conversations helps to build robust substantiation that will be useful in the event of an audit.

In the example below, the expense owner Juliet Roberts sought prior approval by her FO, Sarah Chavez, to rent a mini van instead of an economy vehicle in order to transport a group of colleagues to a conference. The email chain between Juliet and her FO is attached to support the allowability of the expense.

Most Add-Ons are not allowable per IU Travel Policy. Substantiating these additional expenses with justification allows for a more complete audit trail. Add-on expenses without the appropriate justification may be returned to the expense owner for revision.

Questions about Chrome River or Travel? Contact us at ESTC@iu.edu