When money is spent on IU business travel, whether prepaid with an IU credit card or paid by the traveler with personal funds, IU staff are required to submit expense reports in Chrome River to complete the travel process. These reports support a strong IU audit and complete the necessary accounting associated with business travel.

It is best practice to submit IU prepaid items and reimbursements for items paid for with personal funds on separate reports. Read on to learn why.

What is Reconciliation?

If your trip involved any prepaid expenses, those transactions must be reconciled in Chrome River.

Records of these purchases are imported from IU’s US Bank credit card statement and applied to the Chrome River user (AKA expense owner) responsible for incurring those expenses. These records are housed in the expense owner’s eWallet and must be added to expense reports. This process, known as reconciliation, ties the expense to the expense owner, allows approvers to review and approve expenses, and moves these credit card charges to your department’s account.

When do I need to reconcile?

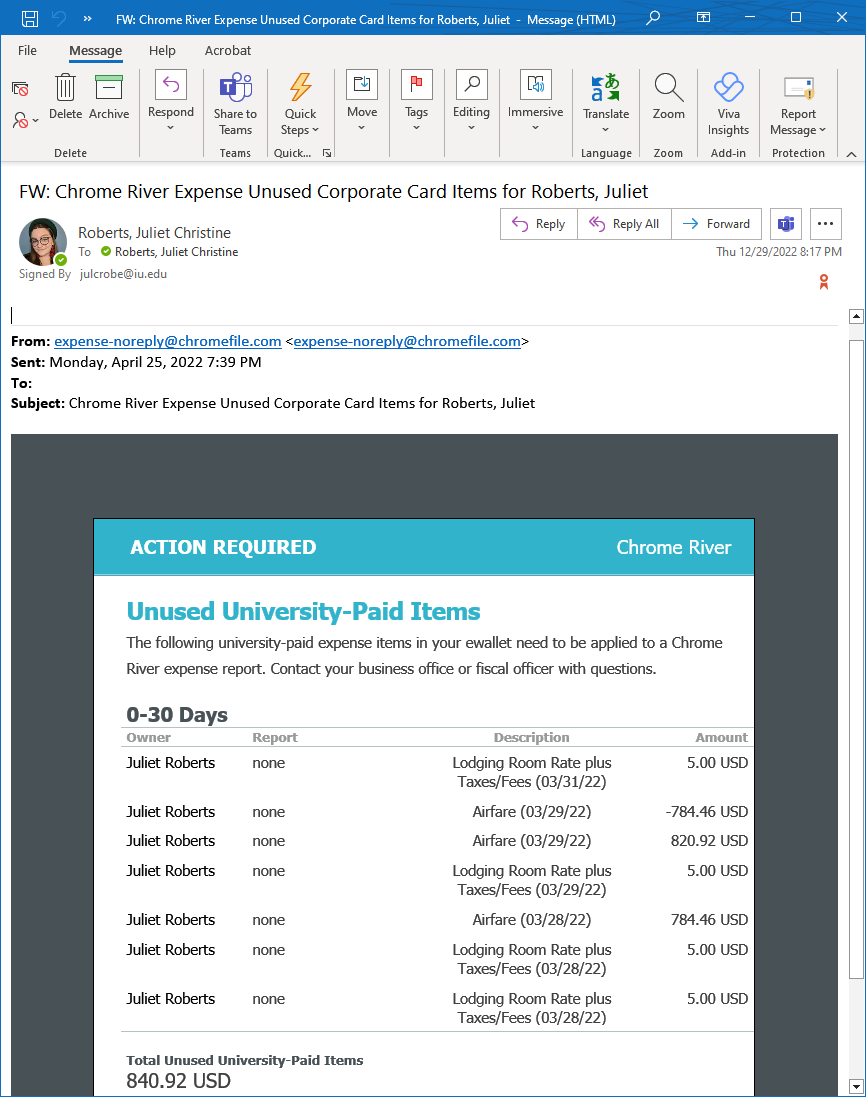

Expense owners receive an email from Chrome River when a credit card charge is added to their eWallet. Different suppliers will charge IU’s credit card at different times, and it can take several weeks for these records to appear.

Prepaid expenses should be reconciled as soon as possible, but ultimately within Accountable Plan guidelines to avoid negative tax implications. If these records appear before your trip, you can and should reconcile before the trip occurs, i.e., as soon as you see the email notification.

What is a reimbursement?

A reimbursement can be almost anything perceived as allowable by the IU Travel Policy and your approver. On most reimbursements, except certain small dollar amounts as defined by Travel Management, receipts must be attached to these expenses in Chrome River. Furthermore, approvers can approve or deny specific reimbursements or adjust amounts at their discretion.

Self-paid expenses must be submitted for reimbursement within 120 of the trip end date or the reimbursed amounts will be reported as taxable fringe benefits on the employee’s payroll.

When do I submit reimbursements?

Unlike IU-prepaid expenses, reimbursements must be submitted after the trip. Note: Frequent flyer miles and any other loyalty rewards cannot be reimbursed for cash. Please do not use these rewards points for business travel.

So, why submit reconciled and reimbursed expenses separately?

Submitting your IU-prepaid expenses and self-paid expenses separately provides several benefits:

- Keeping reconciled expenses separate from reimbursements prevents accidental reimbursement of items prepaid by IU.

- Reports only containing reconciled expenses will have a $0.00 Total Pay Me amount, which helps to eliminate risk and streamline review by fiscal approvers.

- Reconciling early helps keep your expenses tax free and compliant. Failing to reconcile within 120 days of the expense appearing in your eWallet can result in negative tax implications.

- Once reconciliation is squared away, your to-do list after the trip is reduced to just requesting reimbursements.

If your prepaid and reimbursement expenses are commingled on a single report, that’s okay! Submitting prepaid and reimbursed expenses together increases risk but is allowable.

Approvers can learn how to identify prepaid items on expense reports or handle accidental reimbursement requests.