It’s not possible to delete a BUY.IU receipt document. However, incorrect receipts can be cancelled out by logging another receipt. This page demonstrates how to log a negative receipt to rebalance receipts on a purchase order (PO).

Click the button below to learn how to correct that type of receipt.

Quantity Receipt

Quantity receipts capture the number of items received or the number of hours of service performed. Quantity receipts are commonly used with one-time orders.

Let’s look at a scenario:

You place an order with Dell Marketing for 10 laptops and 10 laptop sleeves. You receive a partial order of five laptops. When you logged the receipt, you forgot to update the Quantity field and marked all 10 laptops as received. You need to correct this so that receipts reflect the five laptops that were received.

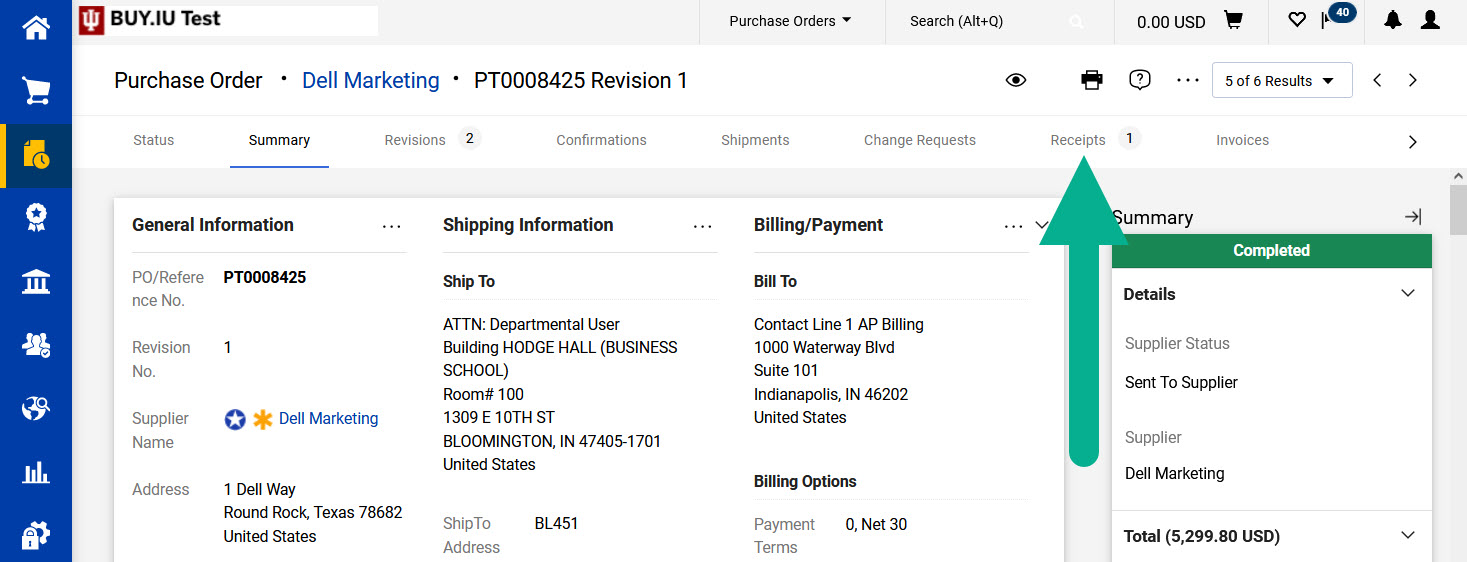

First, navigate to the purchase order (PO) and click on the Receipts tab.

It’s always a good idea to verify what has been received so far. Do this by reviewing the Line Details section of the Receipt tab.

In the screenshot below, we can see a quantity of 10 next to the Net Received line. This confirms that 10 laptops were marked as received.

Click the plus icon in the upper right-hand corner to create a new receipt.

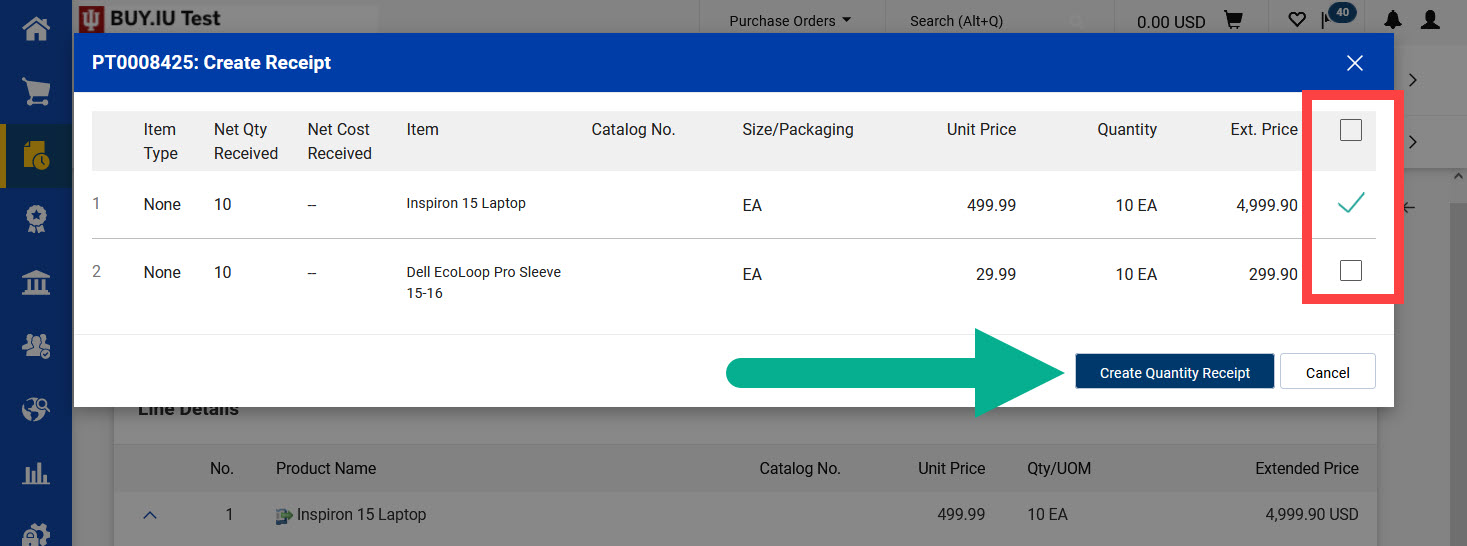

A pop-up window opens which displays PO lines. Uncheck the PO lines that do not need to be corrected.

In this example, we only need to correct PO line 1 so we will uncheck the box next to PO line 2.

Click Create Quantity Receipt.

On the receipt document, update the Receipt Name field to reflect the action taken in this document. Click Add next to Attachments to upload supporting documentation, such as a packing slip or invoice. This is not required by Purchasing but may be required by your department.

In this example, we entered “Correcting laptop receipt logged on 11/4.”

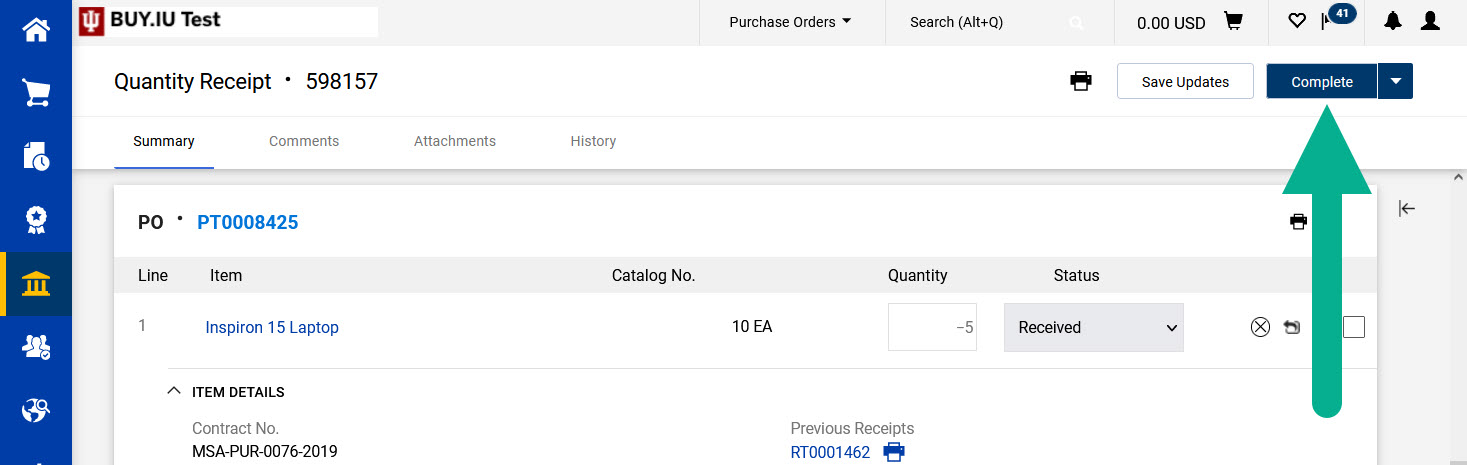

Scroll down the page to the PO Lines section of the receipt. Enter a negative quantity in the Quantity field. When BUY.IU combines this new, negative receipt with previous receipt(s), the overall received number will be correct.

In this example, we will enter “-5” in the Quantity field because we meant to log a receipt for five laptops.

10 laptop receipt + (-5 laptop receipt) = 5 net laptops received

Update any additional receipt lines, review your work, then click Complete to save and log the receipt.

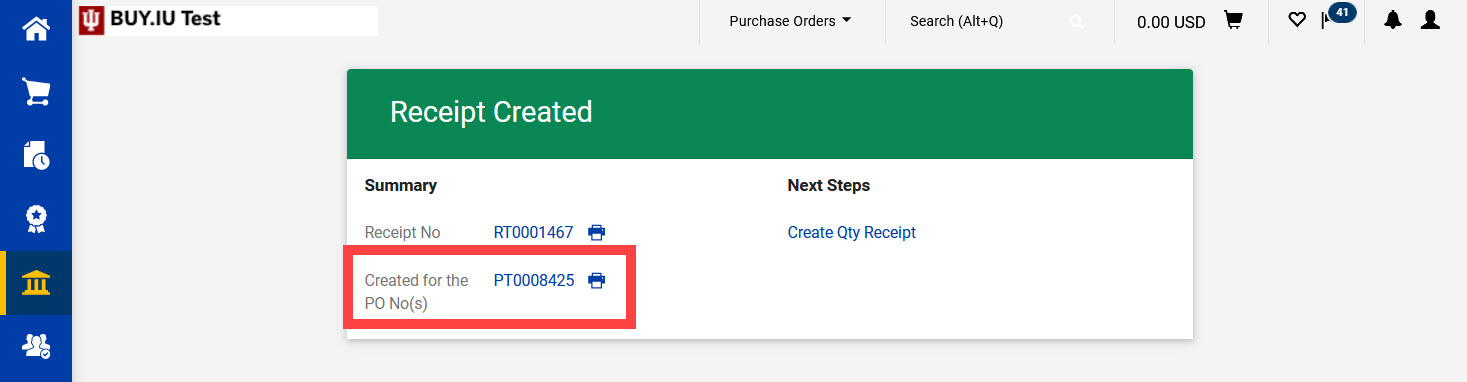

BUY.IU displays a confirmation message like the one pictured below. Click the PO number and navigate back to the Receipts tab and check your work.

Scroll down to the Line Details section of the Receipt tab and review PO line 1. The PO line now reflects an Open value of five and a Net Received value of five.

This means we are expecting five more laptops to be delivered (Open) and have logged the receipt of five laptops (Net Received).

Receipts on this PO have been corrected. If you see additional PO lines that need to be rebalanced, create another receipt following the steps outlined above.

Cost Receipts

Cost receipts capture the value of goods received or confirm that services were performed. This type of receipt is used with recurring orders, capital asset purchases, and subawards.

Let’s look at a scenario:

Your department rents office space from Olympus Properties, LLC. Each month’s rent is $5,000, and payments are made using a recurring purchase order (PO). Last month, the first rent payment was due. You forgot to update the amount in the Cost field and accidentally logged a receipt for the entire year’s rent. You need to correct this so that the PO reflects one month’s rent payment.

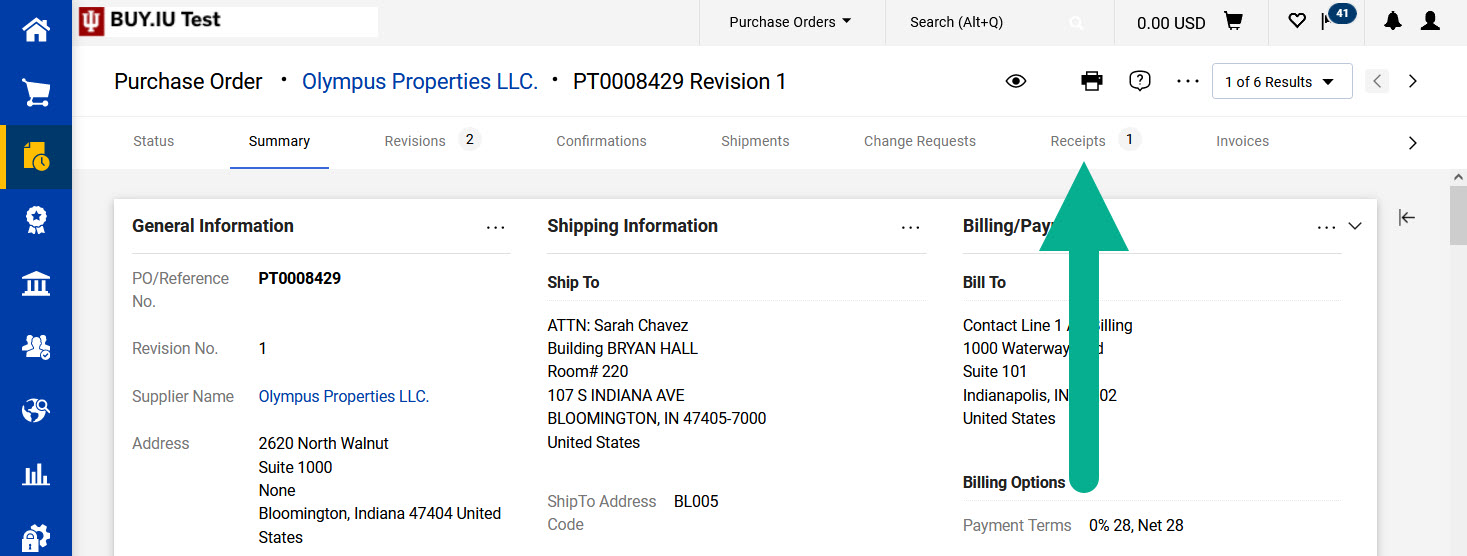

First, navigate to the PO and click on the Receipts tab.

It’s always a good idea to verify what has been received so far. Do this by reviewing the Line Details section of the Receipt tab.

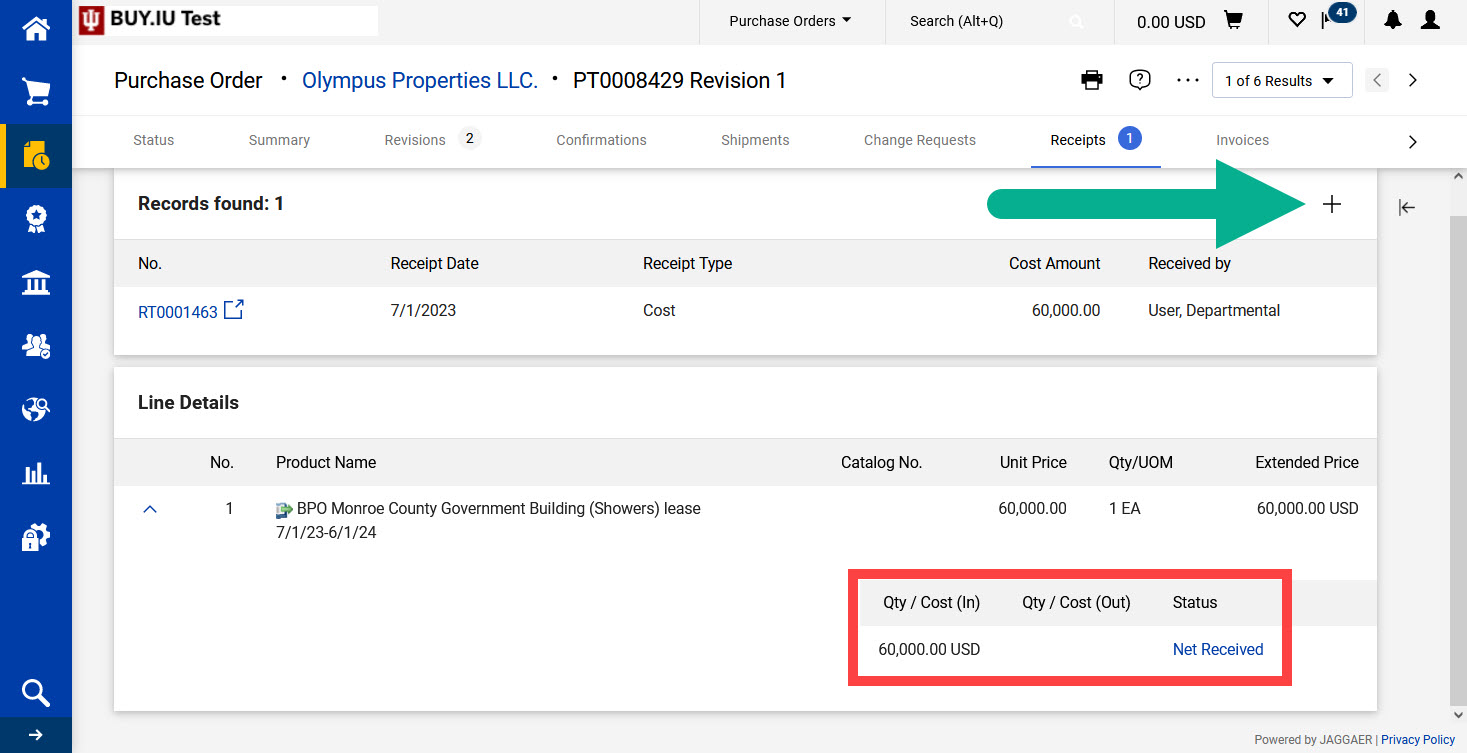

In the screenshot below, we can see a value of $60,000 next to the Net Received line. This confirms that an entire years’ worth of rent was logged as received.

Click the plus icon in the upper right-hand corner to create a new receipt.

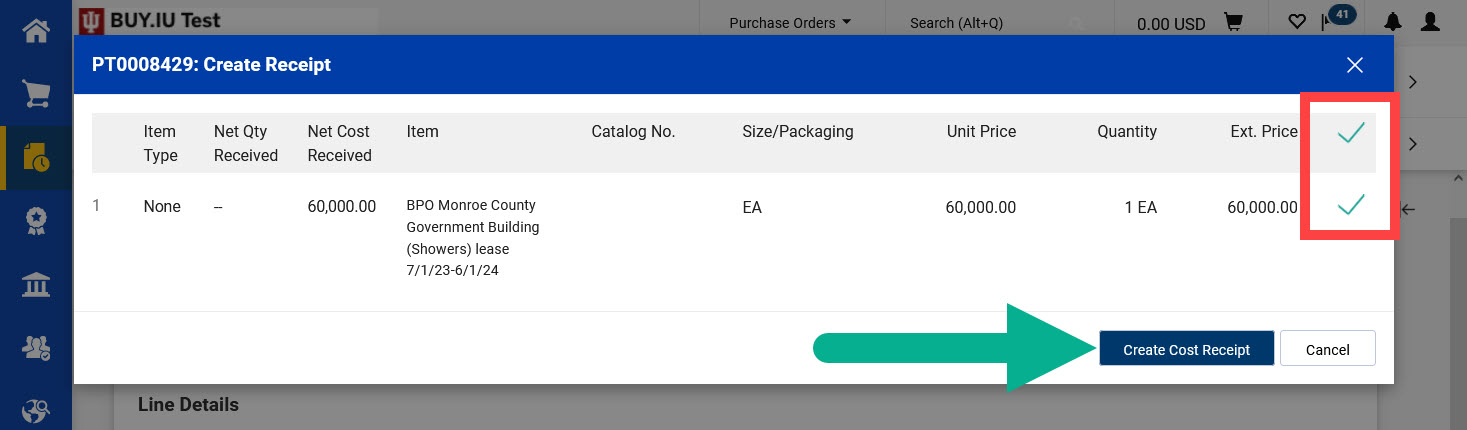

A pop-up window opens which displays PO lines. Uncheck the PO lines that do not need to be corrected.

In this example, the PO consists of only one PO line, so we will leave PO line 1 checked.

Click Create Cost Receipt.

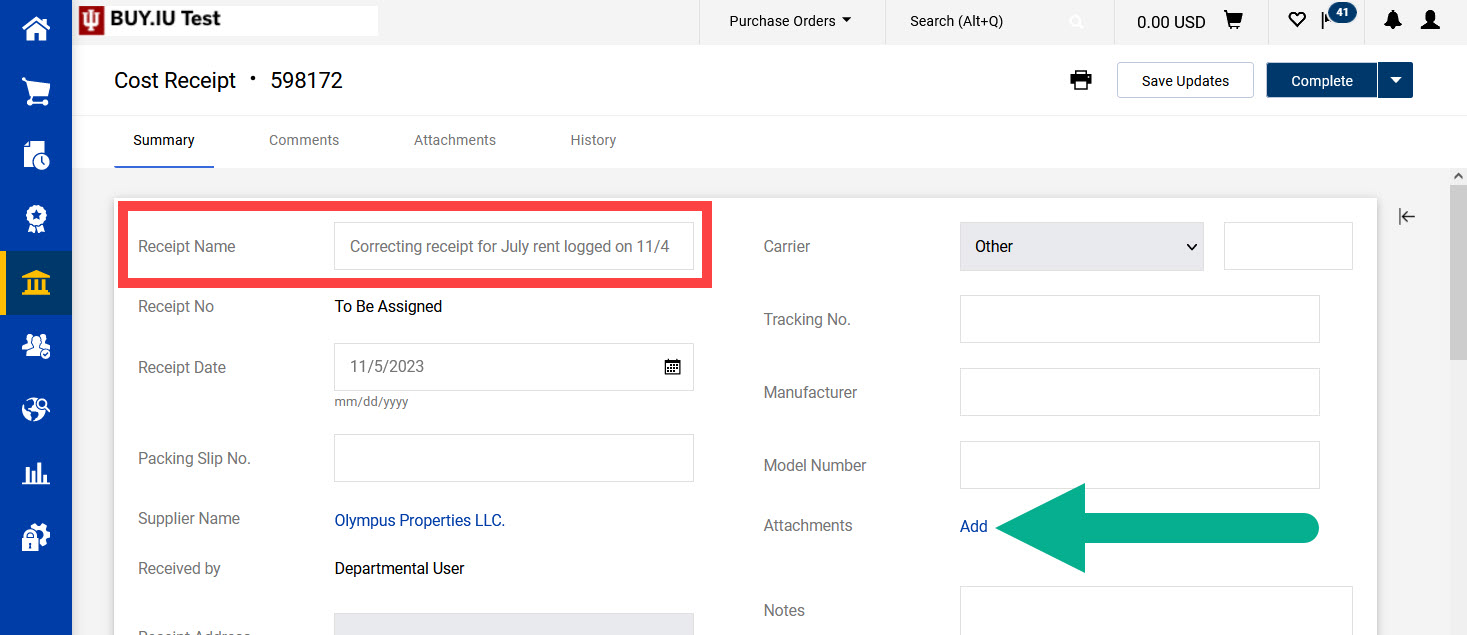

On the receipt document, update the Receipt Name field to reflect the action taken in this document. Click Add next to Attachments to upload supporting documentation, such as a packing slip or invoice. This is not required by Purchasing but may be required by your department.

In this example, we entered “Correcting receipt for July rent logged on 11/4.”

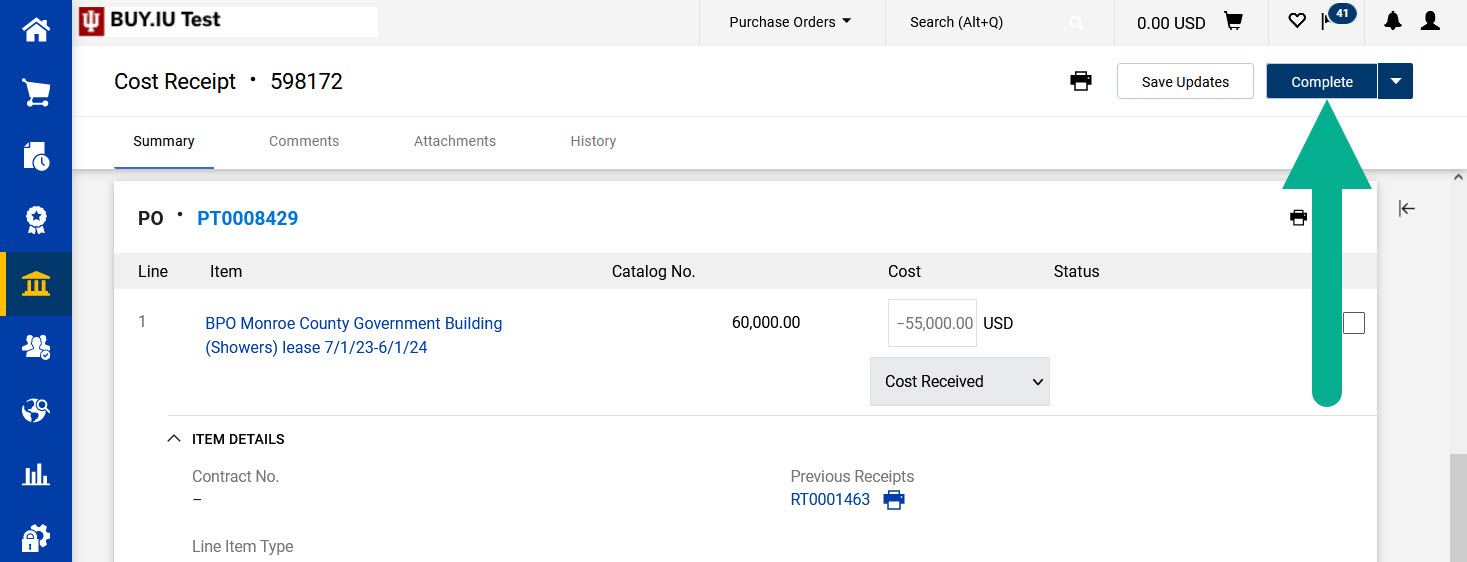

Scroll down the page to the PO Lines section of the receipt. Enter a negative amount in the Cost field. When BUY.IU combines this new, negative receipt with previous receipt(s), the overall received number will be correct.

In this example, we will enter “-55000” in the Cost field because we meant to log a receipt for one month’s rent.

60,000 rent receipt + (-55,000 rent receipt) = 5,000 net rent received

Update any additional receipt lines, review your work, then click Complete to save and log the receipt.

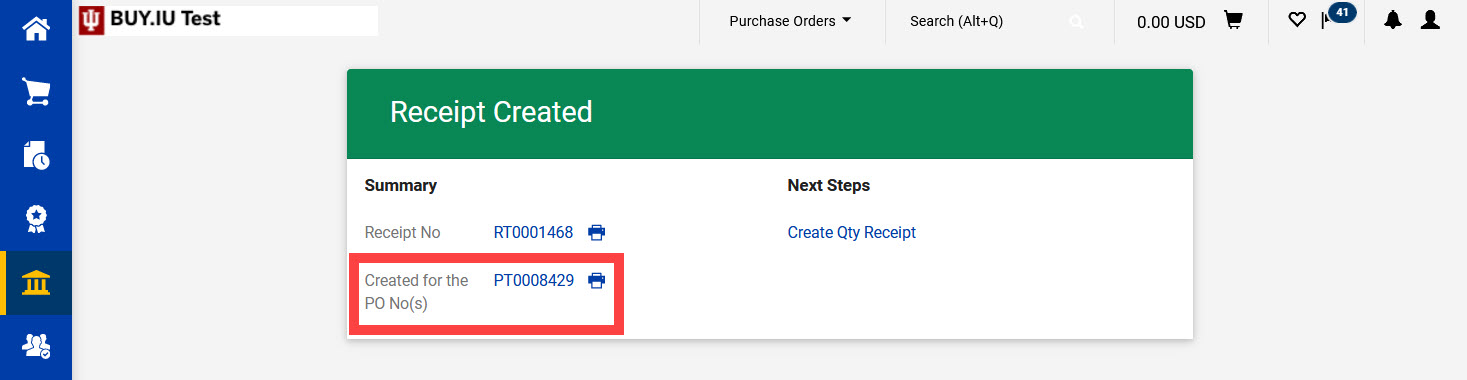

BUY.IU displays a confirmation message like the one pictured below. Click the PO number and navigate back to the Receipts tab and check your work.

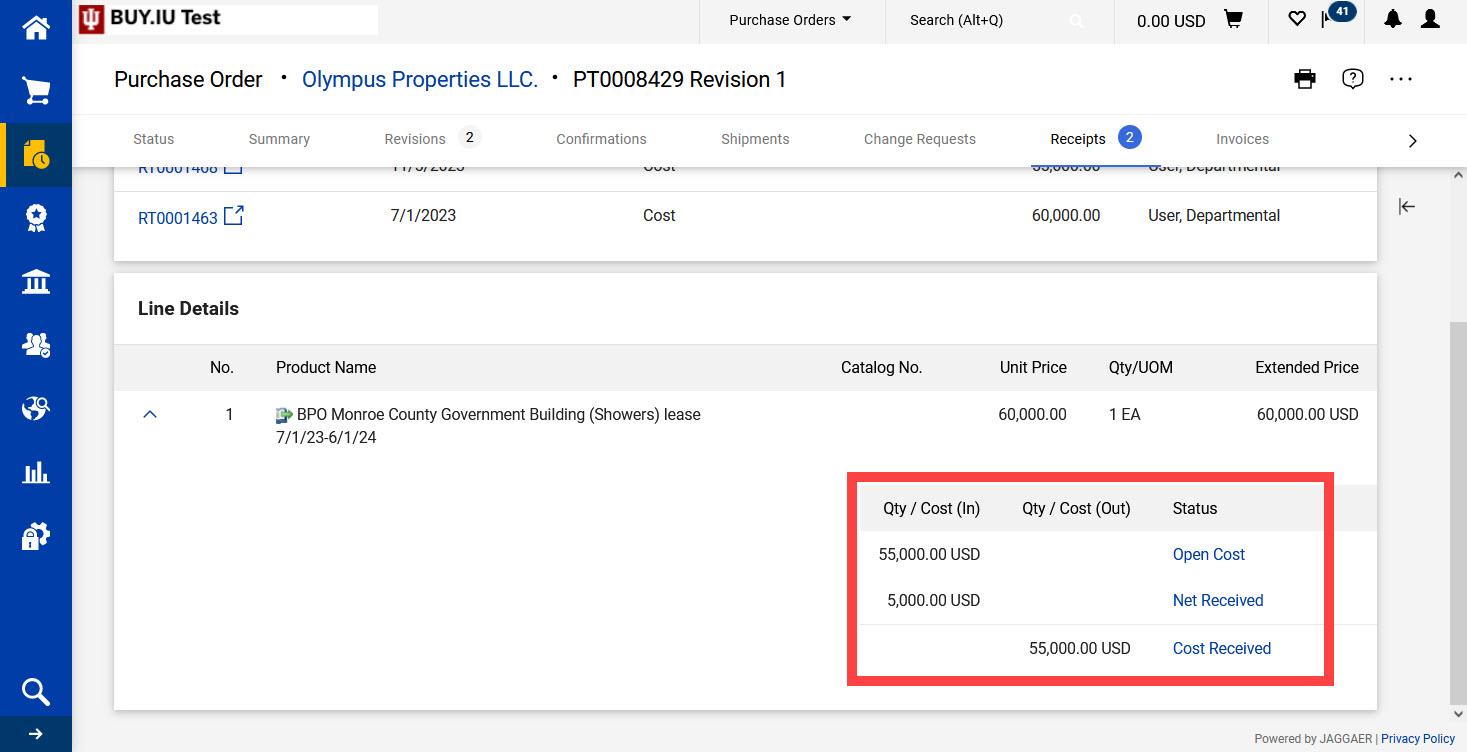

Scroll down to the Line Details section of the Receipt tab and review PO line 1. The PO line now reflects an Open value of 55,000, a Net Received value of 5,000, and a Cost Received value of 55,000.

This means we are expecting $55,000 worth of additional rent payments (Open), have confirmed the payment of $5,000 rent (Net Received), and logged a receipt correction of $55,000 (Cost Received).

Receipts on this PO have been corrected. If you see additional PO lines that need to be rebalanced, create another new receipt following the steps outlined above.